By Siobhán FitzGerald on 31/08/2023

Topics: E&C Consultants, Energy Markets, Energy Transition

For the first time in E&C´s history, we’re celebrating a retirement. And it’s not just someone, it´s Luc De Leersnyder.

In April 2005, Luc was one of the founding fathers of our company. Benedict De Meulemeester and Luc were E&C in its very first moments. For years, Luc was the first face of E&C for many of our clients. As the company grew, Luc focused on business development and HR, meaning that the more seasoned E&Cers also remember him as the person that took their job interview. We owe a great amount of gratitude to Luc, as he made such an immense contribution to the unique story of our company. As Luc sets his eyes on further horizons, he leaves E&C a diverse enterprise with 32 nationalities and 24 languages, supporting 252 clients in 102 countries and 44 states (as of June 2023).

In this interview, Luc shares his unique perspective and discusses E&C´s history and the immense changes he has witnessed in the energy industry during his career.

It was 2005 when we started up E&C. Benedict De Meulemeester and I worked then for another energy management consultancy. The energy market was changing fast, but existing consultancy companies were reluctant to adapt. Seeing those opportunities, we decided to step out and embrace the challenges that this changing market posed. We founded E&C.

I assure you, those were tough times, but it gave us a lot of fulfilment every time we had results. We had setbacks, but as you know, what does not kill you makes you stronger. This is exactly what happened. We grew client by client, we hired people in different countries, set up new offices in Europe, then the US and today all over the world. E&C became a global player in 15 years – this without any acquisition! Something to be proud of.

Could you tell us what developments you witnessed within the energy industry during your career?

Could you tell us what developments you witnessed within the energy industry during your career?At the start, energy markets in many European countries were evolving from regulated to deregulated. As a consultant in a regulated market, you can only check whether the client pays the right tariff and if the invoices are correct. In many countries worldwide today, this is still the case.

The first challenge for clients in a deregulated market was to negotiate an energy contract. In the beginning, you could only choose between a fixed price or a floating price contract. For big consumers, the question soon became how to get more flexibility. So, step-by-step, suppliers started to offer so-called ‘clicking’ contracts, where you can negotiate a frame contract for several years and afterwards start to fix prices at different moments for different periods of time. Customers suddenly had the opportunity to fix on yearly, quarterly, and monthly markets, and combine this with spot prices. This complexity was a great challenge and a consultant like E&C was needed to support clients.

As energy prices increased, the influence of the energy cost on the margins of companies grew. Consequently, higher management became more and more involved. Before, energy procurement was controlled locally. Today, higher management wants a global view on the energy situation. This not only means a global strategy, but also an IT system where information on consumption and budgets are centralized. Centralized energy management platforms were another particularly important evolution.

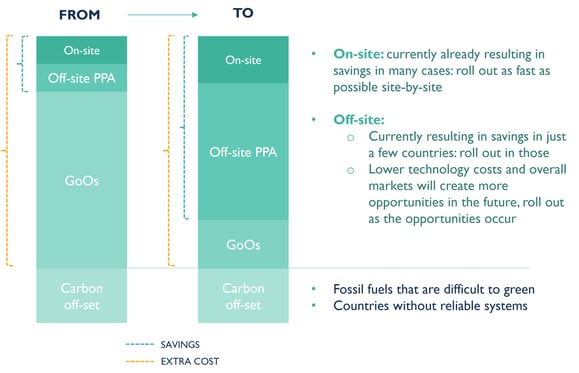

This information is not only used to keep energy costs under control but also to set up the energy transition strategy and its implementation. These days, clients can choose to buy green energy, produce it on site with solar panels or windmills, or participate in so-called off-site Power Purchase Agreements, where you can buy energy from green sources like big solar panel fields or off-shore windmills or a combination of both.

Yes, it introduces further complexity for the energy buyer. Those off-site Power Purchase Agreements (PPAs) can be attractive, but there is a lot of difference between the offers and the risk level. Moreover, those are long-term agreements. You´d better think twice before you sign those contracts. Finally, hydrogen could become very important as a substitute for natural gas or oil. It could be the next hot thing.

E&C always follows the development of the market and its possibilities such as those I just described. The first challenge was to support the client in signing an energy contract that best fit the company and its strategy, which is still the case today. Very quickly, we saw clients struggling with the price fixations: what is known as ‘clicks’ or ´hedges´. Most other energy management consultants use some kind of market prediction. They try to predict the energy market prices using market forecasts and systems like ´technical analysis´. But you just can’t predict what happens in the world. This leads to big mistakes. Who predicted the financial crisis, the pandemic, the Ukraine war, but also the weather during summer or winter? This is not the right solution. Risk management is a technique that was already developed in other financial markets, but not yet in energy procurement. E&C adapted those risk theories and practices to the energy procurement market, with success. Clients can now take forward positions based on the risk of the volatile market on their bottom line. We then developed tools to translate that energy-buying strategy into actions: clear advice on when to click and how much.

As we were working increasingly for international clients with many sites in different countries, the need for good and correct data management became particularly important. E&C invested in the development of such a system. Today, clients can find all the information they need on their customized ePoint system. Those data are important to take the right decision, not only during contract negotiations, invoice control and budget, or risk management, but also to take the right steps in the energy transition.

During the last few years, companies have become aware of the fact that they need to ‘green up’ their energy consumption. The energy crisis and the extreme high prices helped a lot to put energy on C-level´s agenda. In too many companies, however, the energy procurement team is not involved in the energy transition strategy.

Companies need to readjust their thinking so that decarbonization is not considered separate from their other energy management services but that it is incorporated into their core energy management strategy – and in the hands of the energy buyers. These buyers need to understand the full strategic picture to make decisions for the future. They need to know the answers to questions such as:

So, you see, companies are faced with important challenges today. An overall strategy made by C-level is necessary. The translation of this strategy into action plans for the different countries is even more challenging. Companies need correct information and the right expertise.

| A step-by-step risk management approach |

|

Two important questions big energy users should ask are:

Independence from your external advisers is crucial: we´re talking about a long-term decision (15 or 20 years). It’s a lot of money with big risks, which means that sellers of projects will promise you heaven. You need to make calculations with correct data and information. There is no such thing as a standard best solution. Every company must make the choices that fit their consumption and risk profile. A consultancy like E&C provides both the system with the information and the independent advice. We help our clients take the right decisions for their energy transition.

E&C will continue to adapt to ensure they give the right answers to all the questions and challenges the clients are faced with. In this hot energy market, the future is assured.

From my side, I am grateful to have been part of this great adventure. It gave me a lot of satisfaction, and I would do it again without a doubt. For now, I look forward to interesting new things. One of my latest projects is the house I bought in Spain. A great 100-year-old Spanish house in Torremendo at the border of a beautiful lake that needs some renovation. On the first floor, my wife will have a B&B. So, no black hole for me! Hasta la vista!

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu