By Benedict De Meulemeester on 29/08/2012

A few years ago, we used to enjoy the delight of being one of the first companies talking about “the next new thing”. E&C started proposing risk management oriented solutions for purchasing energy to its clients as early as 2006. We would then often hear clients comment: “you are the first consultants that ever talked to us about such an approach”. This obviously was a key factor to our early days’ success. However, the fate of the innovator is that he will be copied. And, as I’ve noticed again, whilst participating in last week’s energy procurement conference in Berlin, a Unipower conference, it is probably very hard these days to find an energy procurement consultant that is not talking about implementing energy risk management. Still, I did observe that we still have quite a different take on it. In this blog article, I want to give a summary of my speech last Friday in Berlin, and I hope that it will give you some food for thought on the energy price risk management practices in your organization.

What is energy risk management?

Evident as it might sound, from the different presentations during the conference, it became clear that an energy purchaser has a variety of answers to this question. To start with, people have a different apprehension of what type of risk the subject “energy” is creating for their organizations. I saw some pretty impressive schemes on risk typologies. Some companies selling products to end consumers, might focus their attention on the risk of being perceived as an unclean company because of the burning of fossil fuel. In large companies, the procurement staff might be facing legitimacy risks if they fail to produce energy contracts that are in line with overall expectations of those contracts' internal stakeholders. A company that is operating on a global scale might focus on the regulatory risk. As each country has its own set of regulations, regional differences can produce risk of delocalization.

As an energy procurement consultancy we tend to focus on the pure market price risk, the risk created by the volatility of the wholesale energy markets. This is also what I did in the conference and what I will do again in this blog article. This doesn’t mean that we are blind to these other risks, you will find my interest in them expressed in other articles on this blog. I focus on market risk for clarity and shortness’ sake. Regarding other risks of buying energy, and before starting my article, I want to briefly point out the financing risk that is now created by natural gas and power procurement. Energy suppliers are increasingly acting as a financial services company for their clients. They procure energy for their clients in the wholesale market. They hedge this energy and they take the financial derivatives for these hedges (futures, forwards, swaps, options) in their own books. They pay the margin calls when these instruments move out-of-the-market. They often pre-finance non-commodity components of the bills: grid fees and taxes. And they deliver all this financial service in the knowledge that in case of a client going broke, they will end up with – best case – three months of unpaid bills. You have to consider that the energy business is one of the few where the supplier cannot shut down the supply in case of non-payment. It is no coincidence that we see ever more strict credit policies from energy companies. Most consumers have contracts that stipulate that their energy suppliers are entitled to demand pre-payments, shorten payment terms or demand a three-month bank guarantee if their credit situation worsens. This means that a company in financial distress is now under the added risk of seeing its cash flow position further affected by an energy company exercising this right to cover its payment risk.

However, as I said, I will focus on the market price risk of procuring energy. As energy prices have seen 200% volatilities in the past five years, it has become clear that energy sourcing at the wrong moment can severely impact the financial solidity of a company. Hence the importance of adopting solid risk management practices. But then, even the presentations during the conference made clear that different companies and/or consultants have different views on what risk management means. I know it’s not the most sympathetic way of doing it, but still, I want to start with a negative definition, making clear what, according to me, risk management is not:

Looking for a positive definition, this is what I found on the internet:

Risk management is the identification, assessment, and prioritization of risks followed by the coordinated and economical application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events or to maximize the realization of opportunities.

Hubbard, Douglas in The Failure of Risk Management: Why It’s Broken and How to Fix It (2009)

I was intrigued by the title and date of publication of the book (which, I have to admit, I haven’t read (yet?)). Back in 2009, right after the debacle of Lehman Brothers, people in the financial sector must have suffered a huge hangover of the risk management party that they had engaged in during the previous decades. They had spent fortunes in developing software systems, building up data center capacity, hiring “quants”, prodigies in mathematics with impressive academic credentials (Chicago!) that helped them to implement the sophisticated statistics necessary for risk management of diversified asset portfolios. Now, despite all these billions of dollars and euros spent, their industry had just suffered the worst systemic crisis in almost a century. And not a million Monte Carlo simulations had helped them avoiding that. (We cannot help but remark the irony of having banks refer to one of the world’s most famous casinos when they describe their risk management methodology.)

Mister Hubbard’s definition makes clear why it will always continue to go seriously wrong from time to time in financial markets. Even in 2009, he could not avoid using the maximization of opportunities in a definition of risk management. Risk management is involved in everything we do in life. When we cross a street, we balance the risk of getting run over by a car with the opportunity of getting to the other side without losing too much time. When we marry, we balance the opportunity of building a happy family with the risk of our partner running of, etc. The overly prudent end up poor and unhappy as their risk-aversion keeps them from realizing opportunities. The overly audacious end up poor and unhappy because they hunt an opportunity that ends up in a nightmare. Success in life depends on our capacity to balance risk and opportunity. Just read one of Warren Buffet’s books and you will notice.

People hate unpredictability. When we step on board of an airplane, we like to have the certainty that there is a 99,99999…% chance that we will actually get to our destination. Human life is supported by an impressive technological system that is completely based on the prevalence of predictability. Science is all about reading future outcomes in present datasets. Therefore, when we enter into markets, we try to find the same degree of reassuring predictability. However, markets are completely unpredictable. Just think about what happened in April 2011. Energy markets were quiet. And then we saw a sequence of events: an earthquake in Japan, a Tsunami striking the Japanese coast, an election in Baden-Württemberg won by the Green Party and a German chancellor shutting down eight nuclear power plants over the weekend in a knee-jerk reaction. Markets for electricity and gas in North-Western Europe were up 20% in less than a week. Anyone that says that he can forecast the energy markets is somebody pretending that he can forecast natural disasters, election results and reactions of politicians …

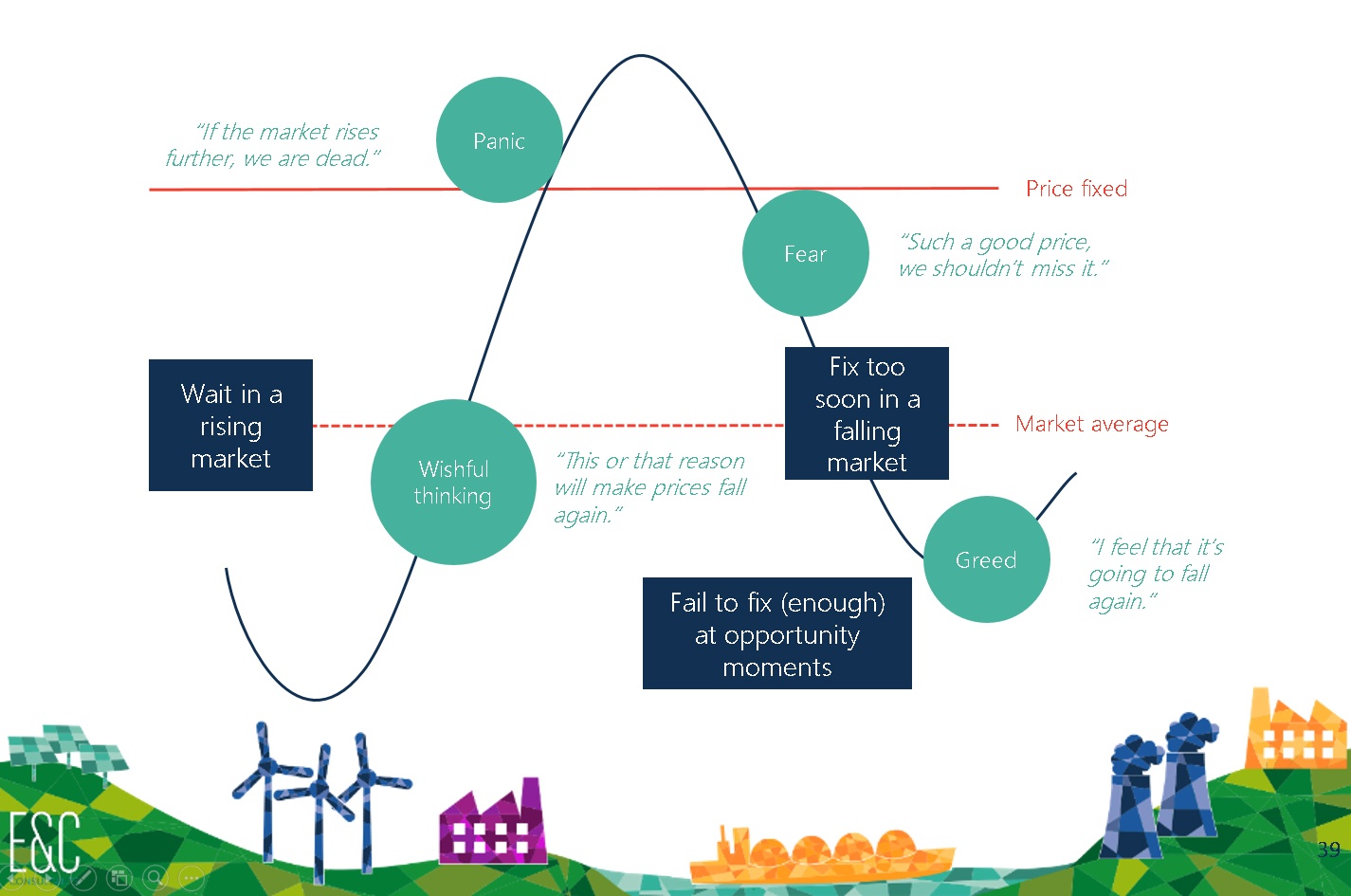

For E&C Consultants, a risk managers’ approach to buying power or some other commodity is all about radically accepting this unpredictability of the market. When people take a price fixing decision, they want to be reassured that prices will (continue to) go up the next day. Well, nobody can say that for sure, not even the most sophisticated market guru. When you take your decision to fix (or unfix) your price, you know only one thing for sure. The chances that the price will go down the next day are equal to the chances that it will go up. If you adopt this 50/50 approach to your energy buying decisions, you will start adopting the necessary degree of prudence to avoid that you take too much risk. Grasping the opportunities is about carefully observing the markets to find the opportunity moments (now, in the present). Risk management is about determining how much you buy in one moment to avoid the risk of potential future market movements.

Energy market price risk assessment

During the conference, there were some animated discussions among the participant end consumers. The companies that presented their approach to risk management all made the case for buying energy in the spot markets. Other participants thought that this was too risky. This made clear that energy market price risk is not the same for every company. Each company has its own specific risk exposure, meaning that each of them will apply their own specific approach to managing that risk. Comparing approaches is pointless, as what is good for company A isn’t necessarily right for company B. Yes, it is true, as some of the speakers have argued, that in the past five years, the spot markets traded some 5% below the average forward market prices. The “Forward premium”, the premium for buying power or natural gas upfront, is not just a theory but in the past five years also an empirical fact. However, for a company that aims at stabilizing the power budget for example, buying all your energy in the spot markets isn’t a good choice of strategy.

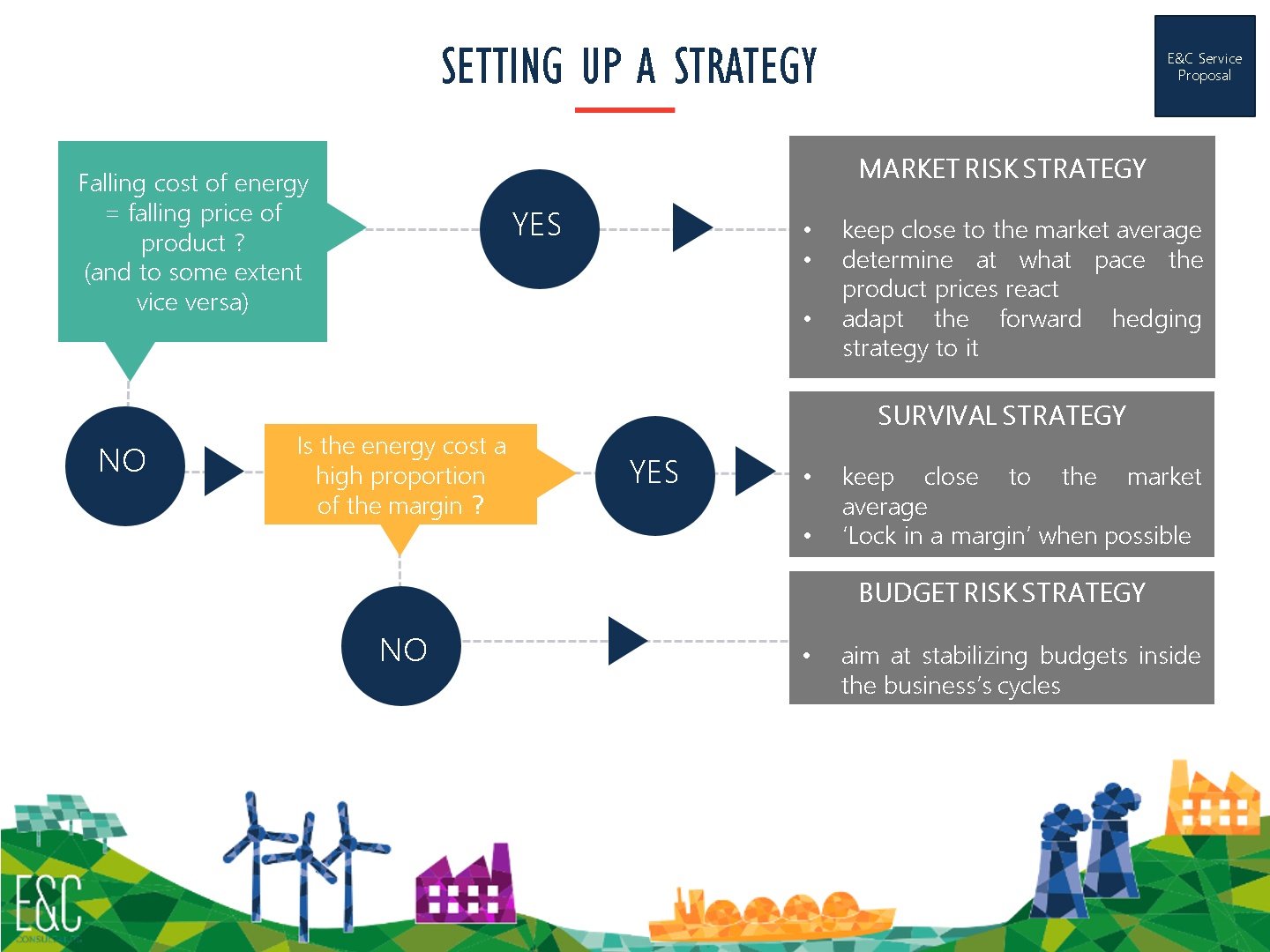

Five years ago, E&C designed a very basis categorization scheme for energy market risk exposure. On the one hand, we have the budget risk clients. These are for example companies that have to put products in the market in a very stable pricing environment. Think about the automotive industry. Or companies producing premium price consumer goods. Or many pharmaceutical companies. They don’t want to see a sudden increase in energy budget as such budget increases eat directly into the profitability of the company. With such companies we design energy buying strategies that aim at stabilizing the energy budget. We apply strict stop loss limits that we watch very closely. When opportunity moments occur, we click prices for several years into the future. Even if there are such phenomenons as backwardation and contango, still we see that at any given moment, the prices for the next calendar products are always close to each other. By fixing the price at the same moment over several of these calendar products, you get a stabilization effect. Ideally with such clients, you can just move from dip to dip and end up having a stable budget below market average. However, this is only possible if you have a market without strong bull runs that oblige you to make stop loss price fixings to avoid budget derailing.

On the other side of the spectrum, we have the category of market risk clients. Such clients put products in markets with strong price competition. Cost decreases because of lower energy costs will immediately be used by some of their competitors to lower the product prices. Although this is often the subject of tough negotiations, such clients manage to raise their prices to a certain extent when energy prices increase. The worst thing that can happen to such a company in the energy market is having bought too much at the peak of the market. In that case, they will see their competitors lower the prices of their products as the energy markets fall. In the case of energy intensive businesses, they will eventually observe that their competitors sell their products at prices below the cost that they have for producing the product. The main pre-occupation of market risk clients is that they don’t pay too high above the prices of their competitors. Of course, there is no information available on what competitors pay. However, if you consider that in the end all the energy is bought according to the same benchmark, namely the underlying power or gas market, the wholesale prices can be considered as the best proxy of what your competitors actually pay. We will therefore click on a very regular basis on this wholesale value to make sure that prices don’t deviate too much from the average value. Of course, the question pops up: which average? In a very commoditized business (I’m talking about the markets the clients sell their products in again), this could be the spot price. In businesses with yearly contracts (e.g. the food industry), this could be the average year ahead price. Through skilful price fixing and unfixing we will then try to manoeuvre the price below market average.

There is a last category of clients that we call – and I know that the choice of word isn’t very sympathetic – the survival risk clients. These are companies that have to operate in markets with over-supply. In such markets, there are always competitors ready to sell products below marginal production costs to protect or gain market share. This means that in case of falling energy markets, such companies immediately feel the pressure of competitors lowering their product prices. On the other hand, when energy markets rise, it is impossible to negotiate a price increase with clients. This is obviously a very tough condition to buy energy in. Basically, we advise such clients to buy their energy very much the same way as market risk clients do. Don’t be the unfortunate company that has to shut down because you gambled and ended up buying too much energy at the wrong moment. We also add to this the advise to ‘lock in a margin if possible’. If prices have reached a level where you are saying, “we can make profits with such low energy prices”, than you shouldn’t hesitate and fix.

As you can notice from what we have discussed above, making up a good energy purchasing strategy not only demands in-depth knowledge of the energy markets. What is mostly needed is a good knowledge of the markets that the client is operating in. This also means that as an energy buyer, you might lack the information for making up the strategy for buying energy. You have to imply other people in this strategy assessment, your top management to start with, as they are the ones that bring the information regarding procurement and sales together. Depending on how energy intensive your company is, this can be the CEO and/or CFO. Key stakeholders of the energy budget, such as business unit or production managers can also get involved. It might even be a good idea to talk to the sales and/or business development managers to get a better view on how the markets work. If companies operate in different markets, it might even be necessary to differentiate strategies for different business units. As you can see from the above, the strategy depends heavily on the particularities of a client’s own business. This means that no two clients have the same strategy. When energy buyers explain the strategy that they apply at conferences such as the one I attended in Berlin, they always try to explain why theirs is the best strategy. This provokes protest from the energy buyers in the audience that come up with comments why theirs is better. This obviously doesn’t make much sense. The question is not “who has the best strategy to buy energy?” (probably meaning: leading to the lowest price). In the framework of risk management, the question is: “who has the energy sourcing strategy that is best fitted to mitigate their specific risk exposure in the energy markets?” Each company has its own best strategy.

Implementing your energy buying risk management strategy

Do you remember the strategy – tactics – operations sequence from (business) school? For the successful implementation of strategy to source energy, this is quite crucial. Once you have your strategy set out and the strategy note written, it is important that you implement the right operational practices to get the desired results. In your day-to-day operations, you can also use a few tactical principles to increase the success of your price-fixing decisions. The most important tactical principle, which we have applied with great success in many cases is: “let the profits run”. Don’t fix a price in a falling market, don’t unfix in a rising market. Wait for the turning point of a downtrend before you start fixing.

If you apply this, it is of course not always possible to distinguish between a turning point and a short-lived uptick. Therefore, we recommend again to adopt a risk management approach to this decision. If you want to fix 25%, fix 12,5% the first day that it turns around and 12,5% if it continues to rise the next day.

In terms of operations, it is obviously extremely important that you adequately monitor your portfolio position. Especially in large organizations with many sites, just keeping track of your different contracts for your different sites might already be a huge challenge. On top of that, you need to keep track of all your price fixings. To take good price fixing decisions, you need to know your portfolio values: “what will I pay next year, if I fix everything now, taking into account what I have fixed already and what the market price is now?” Your management will probably also be interested in mark-to-market values: “what would we pay, if we hadn’t fixed anything yet?” You will be asked to keep track of your clicking performance: how are you performing against the market (average)? If you have minimum and maximum percentages to be fixed by certain dates, you will have to make sure that you know how much you have fixed at any point. If you have stop loss limits to watch, you need to monitor them, and you will have to roll out some sort of value-at-risk calculations to make sure that you make (partial) fixings in time to avoid going over your stop loss level. If you are having one production plant, with one simple four-clicks on the Calendar products contract, this might still be relatively easy. But what if you have to monitor 30 sites with 6 contracts and fixings on Cals, Q’s, M’s, volumes left open for the spot market, etc? How will you keep track of your unfixing decisions if you take them? How do you keep track of future volume changes? Of course, your energy supplier can help you with portfolio monitoring. However, you have to be careful that depending on your supplier for your monitoring needs is not necessarily good for your position in contract negotiations. As an energy procurement consultant, we have invested a lot in setting up portfolio monitoring tools on ePoint, because we see that many organizations struggle with this. You wouldn’t be the first company that loses an opportunity or is confronted with a surprise budget increase because you didn’t have a timely and correct view on your portfolio positions.

Once you have your monitoring under control, you need an important instrument to execute the strategy: the right energy contracts.

At this moment, we see the current approaches to energy price fixing:

It is important that you are aware of where your organization is, to choose the right contract type. For example, don’t choose a energy market average only because somebody messed up the fixing decisions due to a lack of strategic discipline. Don’t move to full scale trading if you haven’t mastered working with a clicking contract yet, as it adds complexity for which you might not be ready yet.

Which brings us to the subject of people management. Organizations that choose one person to take all the price fixing decisions are running the risk that this person messes up. You need some other people involved to check this. On the other hand, if too many people are involved, you run the risk of ending up in decision paralysis. Seven years ago, a client of ours had created a “steering committee” that was to decide on every fixing. Every time that there was a moment in the market, we were called in front of that committee and we had to bring a presentation on the markets. In the following hour, these people would start a massive discussion on the state of the world economy and the impact they thought this would have on the energy markets. At one moment, one of the people in the committee took a firm position and pushed through the decision to make a large electricity price fixing. And then came the crash of electricity prices in the spring of 2006 … In the next steering committee meetings, the person that had pushed the fixing decision was again and again blamed for his wrong view on the market. This created a very tense situation in which everyone was extremely reluctant to decide on a energy price fixing. As a consultant, I found myself in a very difficult position. As long as I was giving arguments why this might be good moment for fixing the price, everybody was “watching the tips of his shoes” and avoiding the sort of eye contact that obliges you to take a position. When I uttered just a hint of an argument why it could be good to wait a bit longer, a massive sigh of relief was heard around the table and a decision was taken … to fix a date for the next meeting. This is just one of those client experiences that taught us how to approach energy price fixing decisions in companies. And one thing is clear: joint-decision making doesn’t work for decisions in unpredictable markets. You need to designate one person that makes the calls, at most you can have him sparring with one superior, but don’t get more people involved. Get as many people involved as possible in setting up the strategy. But then these people need to trust (and monitor) that the person that makes the fixing calls will realize the strategic targets by applying the targets correctly.

Conclusions

Applying risk management doesn’t mean that you will try to get the best possible price out of the market. Many energy sourcing consultants have sold “savings” for such a long time to their clients that they now try to sell risk management as something that makes you save money, something that helps you winning money by getting a better price. Well, risk management is not at all about saving or wining money, it is all about avoiding that you loose money. Sounds similar, but if you think well about it, it is not exactly the same. Just think about the difference between entering the casino with the aim to win money and entering the casino with the aim not to lose money. When markets were liberalized, industrial consumers entered them with the conviction that they would win money, that they would make big cost reductions. I think we now have experience enough to acknowledge that our first concern should be not to lose too much money. The first target of any energy buyer should be: “make sure that you don’t jeopardize the financial security of your company by fixing too much energy at the wrong moment”. By applying a strategic approach to managing energy market price risk, companies can successfully mitigate the risk of volatile energy markets to their businesses. However volatile the markets are, by applying what I described in this article, companies get budgets that they can live with. They are managing their budgets instead of being thrown about by the market movements. I am happy when a client never has to say again: “now I can only hope that the market will move up”, or “now I can only hope that the market will move down”. A risk manager’s approach to buying energy is all about excluding hope and managing your budgets instead. And if you manage your budgets successfully, you will also start making better use of the opportunity moments.

Successfully implementing a risk management strategy when sourcing energy isn’t a very easy task. Here are some of the main obstacles that I have observed over the years of advising clients on it:

Applying a risk manager’s approach to energy sourcing can help you in getting control over your energy budget. I hope you have understood from this lengthy blog article that it’s all about applying simple logic. However, implementing it you will run into many difficulties. But I have a busload full of success stories to show you that it can work.

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu