By Bartosz Palusiński on 8/08/2017

Topics: Energy Controlling

Polish version: https://www.eecc.eu/blog/ustawa-oze-nadchodzące-zmiany

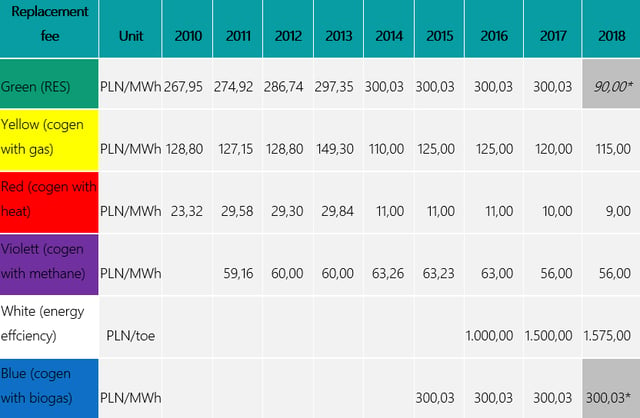

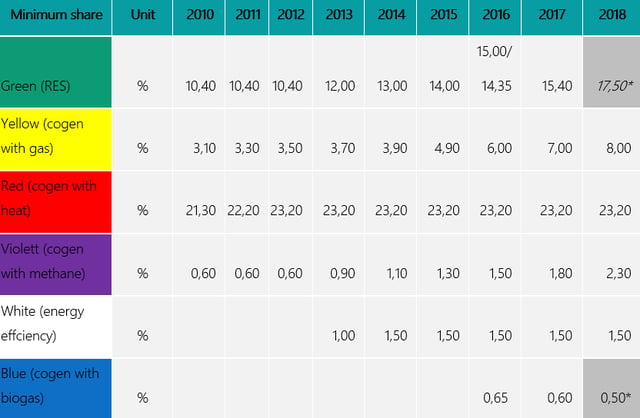

A few years ago Poland developed the “property rights market”. The system should support electricity produced from renewable energy sources and cogeneration with gas, heat and methane from mines and biomass and on the top of it energy efficiency. It’s commonly referred to as the “colours market” since each certificate has its own colour. However, replacement fees and obligatory shares are continuously being adapted:

*project, not approved yet

*project, not approved yet

The current parliament and government are now working on changing the polish renewable law, both the replacement fee and the share of blue and green certificates of origin. The blue certificates support biogas power generation.

On the 12th of July 2017 the lower house of the Polish parliament (called Sejm) submitted an amendment to the act on renewable energy sources to the Polish parliament. This amendment aims at changing the calculation of the replacement fee for the green and blue certificates of origin.

Each energy supplier must prove part of its energy is coming from green energy. To do so, they acquire certificates from different sources such as bilateral agreements or they buy them from the stock exchange. In case they didn’t manage to acquire the certificates, the replacement fee is applied.

The aim of the new amendment is to bring the level of the replacement fee closer to the market value. The level would be set at 125% of the annual weighted average price of each certificate. For the green certificates, this would mean the new fee would be set around 90 PLN/MWh for the year 2017 whereas it used to be 300,03 PLN/MWh and the current market prices are around 32 PLN/MWh.

The situation is different for the blue certificates as the weighted average price on the energy bourse exceeds the cap limit of 300,03 PLN/MWh. Hence, it will not be changed.

Linking the replacement fee to the market value is a remarkable adaptation of the system. In certificate markets, such replacement fees have an impact on the pricing, as they set the maximum at which the market could trade. When prices in the markets trade below the replacement fee, it means that there is excess supply, i.e. the amount of e.g. green electricity produced is larger than the obligatory share.

In case of a shortage, the price would rise to the replacement fee and then stop rising, as suppliers would choose to pay the replacement fee instead of buying certificates in the market. If you say that the maximum is 125% of the market price, what happens to that price in case of a shortage? Will it rise infinitely as your replacement fee is always higher than the price in the market? Or will we see strange price evolutions due to the mathematics of current versus average price level?

The changed calculation may have a positive effect on households because a reduction of the electricity tariffs is expected by lowering the cost of green certificates and blue certificates. The change may also be favourable for consumers that have an electricity contract where the cost of meeting the green certificates is based on the replacement fee and not the market price of certificates. For the latter, the change would be neutral.

The amendment is now waiting for the president’s signature. Once the amendment of the RES act is published in the Journal of Laws, it will come into force 30 days after its publication and will be applicable for energy consumed in 2017.

In the meantime, the Ministry of Energy has also been working on adapting the share for green and blue certificates.

The share would decrease from 0,6% in 2017 to 0,5% in 2018 for the blue certificates and increase from 15,4% in 2017 to 17,5% in 2018 for the green certificates. As the increase amounts for more than 2%, this could have a direct impact on the electricity prices since an increased number of green certificates will have to be included in each MWh of electricity. The increase may also impact the demand for these certificates and thus potentially higher market prices. However, there is a huge oversupply of green certificates on the market. At the end of this year the oversupply can reach around 24 TWh compared to the demand of 17 TWh.

Bartłomiej Derski from portal wysokie.napięcie.pl reported that despite the increased share the oversupply can last for the next 5 years:

After the announcement that the share of green would be increased for next year, the market price of green certificates increased from 25 PLN/MWh to 42 PLN/MWh and then fell again to 30 PLN/MWh.

The draft regulation is expected to come into force on the 31st of August and will apply to the green and blue certificates obligation for 2018.

Do you want to stay up to date about regulatory changes?

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu