By Benedict De Meulemeester on 23/03/2020

Topics: Energy Markets

We are all going through a world crisis the like of which we’ve never seen in our lifetimes. A few years ago, I was trying to convince a client not to fix too much in a bullish market. You know, the typical discussion where someone is so overwhelmed by rising energy prices and news articles that they are convinced that markets will never come down again. The client asked: ´what could possibly happen that ends this bull run?´ I think this was in the days of SARS or bird flu. I answered: ´this could develop into a pandemic that disrupts economic life´. The client was laughing loudly and concluded, ´if you need that kind of hypotheses, I’m sure that this bull trend will continue´. Well, today’s situation proves that nothing is impossible, that energy markets are truly unpredictable and good risk management takes into account the possibility that any risk, however small its chance factor, can happen one day.

Our hearts go out to the people who are personally affected by the virus itself of course. Let there be no doubt: we need to do all we can to stop this virus, protect people and keep our healthcare systems functional. It is therefore, with a justified degree of modesty, that I write about the consequences for our sector — knowing very well by now that there are more serious battles to be fought — but also that we should keep the world as it was before the crisis as alive as possible.

Unfortunately, this worldwide public health crisis threatens to develop into an economic crisis of unprecedented size. China, running a few months ahead of the rest of the world in terms of how this crisis develops, has seen a sharp economic decline. The Financial Times, using its own metrics, claims that economic activity in China dropped to 50%. As shops close people stop spending and whole industries shut down; and we can see this coming in other parts of the world as well.

We can only hope that this will be short-lived, and that the economy will recover when the lockdown measures are relaxed. Indeed, the Financial Times reports that Chinese economic activity is already back up to 60% of its previous level. However, you can see that this is a slow process as the measures to shut down normal social life need to be turned back slowly to prevent a new outburst of the epidemic. We can all hope that at some point, when a vaccination has beaten the virus, there is a kind of ´after the war´ spree of economic optimism that brings us back factories that are spinning at full throttle and companies that see the cash flowing in and invest it in interesting new projects.

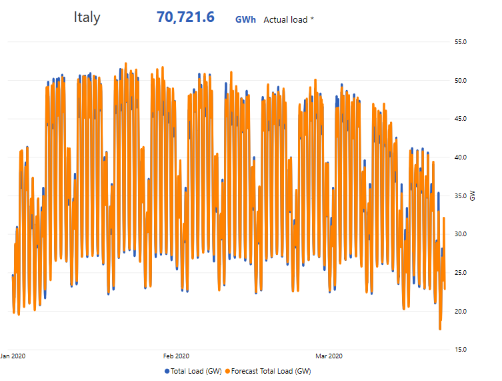

The lockdown and resulting reduction in economic activity obviously have a huge impact on energy consumption. The graph below, from the website of the Italian grid operator Terna, shows the impact of the pandemic on Italy’s electricity consumption and you can clearly see a dramatic drop in recent weeks as Italy has been hit so hard by the crisis:

This drop in demand is the first clear impact of the Corona crisis on energy procurement. In the past two weeks, we have been continuously communicating with clients about the reductions in energy consumption that they see and what steps they have to take towards their energy suppliers. In general, there are two possibilities:

Do you want to keep track of prices? Request a three-month trial and receive our energy reports for free.

During the crisis of 2008–2009, we saw similar volume issues popping up, although we have to hope that this time they will be of a more temporary nature. We’ll do with our clients what we did then, which is search for solutions by negotiating with suppliers to not apply the rules for volume payments too strictly.

The ‘no limits’ volume-based contracts that we could sign in recent years were fantastic, moreover as they often came at low add-on costs. But it’s clear now that by offering these contracts, energy companies have simply assumed too much risk. Unfortunately, it is in the nature of many companies only to start managing risk when it has already materialized. So, we’ve seen in the past weeks how energy suppliers withdrew offers to replace them with new ones with more strict volume conditions. It is to be feared that in the next few years more rigid volume management will be necessary again. Some suppliers have even gone a step further and are cancelling their normal activities, such as participating in RFQs or offering hedging services. If this is due to too many employees being ill, I obviously can understand this, but energy companies need to prove to their clients that they can also be a partner in adverse times.

And of course, there is the question of whether some energy suppliers, having taken too much risk in their limitless forward fixing contracts, will not try to use force majeure clauses to switch costs back to clients. In many countries, we also see governments interfering in the markets to try to manage the economic consequences of this crisis. In some countries they are already explicitly looking at energy bills, albeit mostly in the residential segment. Although I am a convinced energy-market liberal, I understand that these exceptional circumstances justify some interventionism. However, we will have to check carefully whether this interventionism is also aimed at protecting large consumers of energy, essential for keeping the economy of a country running. And of course, in countries with cosy relationships between energy companies and governments, we should beware of interventionism that turns into favouritism.

Doctors, nurses and other groups of professionals directly involved in this medical emergency are currently delivering heroes’ work, for which they deserve so much more than the applause we give them through our windows. It makes you realize how relative our busy-busy professional life actually is. But on the other hand, we as business people also have a responsibility. Last week, two of the clients that I spoke to gave a good description of that responsibility: ´we have to ensure the continuity of our business, as good and as much as we can´. And that’s indeed what we have to do now. It is the added value that our companies create that helps to pay these doctors’ and nurses’ salaries and helps hospitals to buy equipment for them. If, on top of this public health emergency, the economic recession is deeper than it should be because businesses lose the courage to do business, the consequences for everyone will be even graver, in the first place for the poor people in our societies. If companies throw their arms up into the air and stop doing as much business as circumstances allow them to do, more jobs will get lost. And if the energy buyers stop their activities, this can result in higher energy cost due to not avoiding risks and missing opportunities.

To be honest, in the past two weeks, I spent most of my time ensuring a smooth transition of E&C to this new reality. But whatever happens, we are always keenly observing what the world’s reality means for energy markets. This blog article is just a first collection of ideas. I will delve into them more extensively during our webinar on buying energy in times of corona, for which you can subscribe here.

I am sure that in the next weeks new challenges and opportunities from this situation will unveil themselves. We will keep you updated.

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu