By Benedict De Meulemeester on 1/04/2020

Topics: Sustainable Energy Management

2019 was a good year for the energy transition: it was first year when the growth in carbon emissions halted due to a decrease in coal usage. Finally, we had a sign that the move to greener alternatives was paying off. With Coronavirus lockdowns in place and other economic consequences, we will no doubt see the same emissions freeze – or even a drop in emissions – in 2020. February saw a 36% decrease in coal consumption in China, the world´s biggest producer and consumer of coal. In fact, there have been a few startling pictures of how quickly this virus has positively impacted our environment.

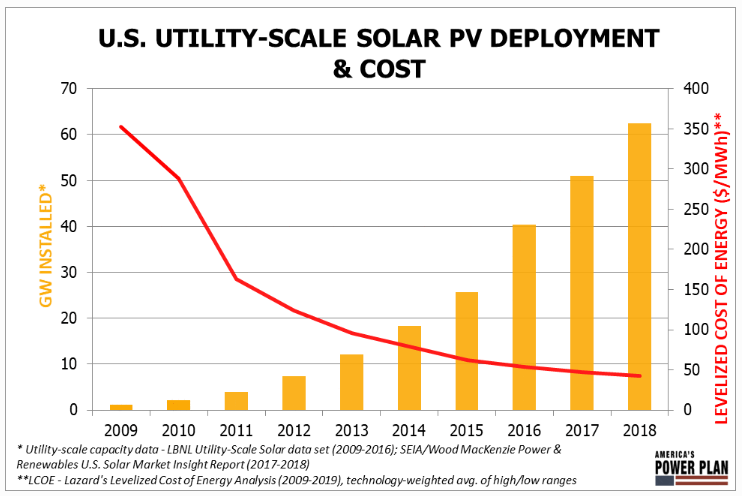

Before this, renewable energy became a good choice for building new energy production due to a drop in technology costs (i.e. photovoltaics (PV) prices dropped by 80% since 2009) and an expectation that renewable energy capacity would more than double over the next five years. The climate change movement increased momentum in recent years with Greta Thunberg gaining international attention and adding public pressure to the need for the energy transition.

Source: US solar cost decline and capacity additions 2010-2018, Forbes

Source: US solar cost decline and capacity additions 2010-2018, Forbes

Consequently, the energy transition has been gaining traction globally. In the months before this crisis broke out, we were discussing ambitious decarbonization programmes with many of our clients. However, due to the Coronavirus, at this moment many CEOs and boards are busy dealing with other things, namely the direct consequences of the crisis. We´ve seen in the news many companies looking inward, tackling different ways to manage their staff, and concentrating on immediate business continuity. What will happen when business normalizes? Will they re-focus on their decarbonization programmes or ditch them?

And what about politics in general? Will this situation lead to a more conscious relationship with our planet, and more attention on a sustainable way of living and decarbonization – possibly including working from home and travelling less? This introduces the possibility of long-term emission reductions if businesses decide to alter their behaviour. Or will the after-the-war-feeling make us so happy that we resume our old ways of living and shroud the planet in a big cloud of CO2? Past behaviour appears to suggest the later, with CO2 emissions shooting up after the 2008–2009 global financial crisis. However, we started off in a different place, so what will Coronavirus mean for the energy transition: boost or bust?

For companies, it will be important to learn lessons from this crisis. Integrating homeworking and teleconferencing into company cultures could be part of a broader decarbonization effort. Also, companies that are feeling the hit of the economic crisis will ask their energy buyers what they can do to reduce energy costs. On-site PPAs, third-party investment in rooftop solar panels, is a secure possibility of saving money. Now, more than ever before, is the moment to look into it. Negotiating PPAs may seem daunting but the opportunities at this moment would be worth investing time in this.

What about off-site PPAs? In the wake of falling natural gas prices at the beginning of the year, electricity prices had a bearish trend (see the latest market analysis below).

This means that many of the off-site PPAs offered at prices below forward price levels during 2019–2020 are now out-of-the-money and are not a good investment at this time. Will this remain so or can off-site PPA price levels drop to levels where it’s interesting again for industrials to look into them?

It´s possible that the cost of wind and PV technology will drop further. Supply chains for these technologies have come under pressure from the crisis, more specifically the lockdown situation in China where a lot of this technology is produced. Once these markets are open again, we might see a situation of over-supply that drives down prices because some of the raw materials, such as silicon or steel, might be under price pressure as well due to low demand.

Will there be a stimulus from the authorities? The financial crisis in 2008 heralded the return of Keynesianism. In fact, we are now seeing a similar reaction, with governments across the world planning to inject huge amounts of money to jump-start suffering economies. The European Central Bank announced a 750 billion euro Pandemic Emergency Purchase Programme. The Bank of England cut interest rates to 0.1% and added 200 billion pounds in quantitative easing, while the US Senate approved a 2 trillion dollar stimulus package.

Left-wing politicians across the globe are pushing for some of that money to be oriented towards the energy transition. During the US Senate vote over the stimulus package, Democrat Nancy Pelosi, Speaker of the House, raised the point that this is an important time to help clean-energy businesses. The idea of a New Green Deal resurfaces. The Trump administration and other conservative governments are showing the opposite and want to channel money towards the airline industry or oil companies. Again, what politicians decide to do with all that public money will mean boost or bust for the energy transition. Fatih Birol of the IEA sure sees the historic opportunity here.

The energy transition might be temporarily on hold due to the Coronavirus, but when the dust settles, we’ll have to see whether it will be boosted or goes bust. As an energy buyer, keep your eyes open for what happens in your organization and in the world.

Are you looking for more information on the impact of the Coronavirus on buying energy? Join our webinar series.

Edited by Siobhán FitzGerald

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu