By Benedict De Meulemeester on 12/11/2020

Topics: Forecasting, hedging, Risk management, Energy Markets

Last week saw a sharp uptick of the workload for E&C’s teams that advise clients on making price fixings or hedges and the teams that have to process them on our ePoint platform. This was caused by an uptick in forward markets and supported by higher spot prices, which made many clients realize that the low prices seen in April–May might not come back. As we are already in November, in many cases our consultants and their clients were discussing the crucial question:

“Should we do our last fixing(s) and have 100% of the price fixed for next year?”

This question comes back every year in this period and I want to give some guidance for answering it in this article. Unfortunately, there is no short straight-forward answer. We need to look into the current market dynamics, talk about trends and trend reversals and what they teach us about unpredictability of markets, and then we need to explore the risk management practices we can put in place to minimize the impact on our business of that unpredictability. Once we have that established, we will have very concrete guidance on what to do in this current market situation. So, let’s have a look at what’s going on in the markets at this moment.

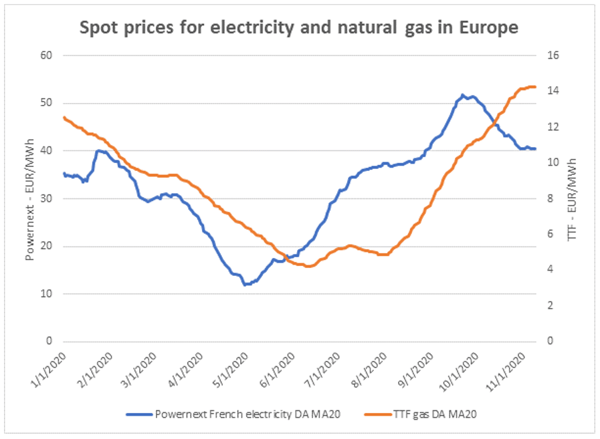

As mentioned, many forward markets on which you can execute your hedges displayed a sharp uptick. We – and the news articles that cover it – tend to relate this bullishness to the big news items of the moment, such as the US elections and the progress made in developing a COVID-19 vaccine. There is some correlation, but it’s important to look beyond that at some more fundamental dynamics. We’ve also seen gradually increasing spot prices in the last months, and spot prices don’t lie, they reflect true supply and demand dynamics.

What’s going on? On the one hand of course, the lows seen in April–May were caused by the drastic demand cut of the first lockdown when economic activity was largely shut down. Many European countries are now going through a second lockdown, but not with the same cuts of economic activity that cause energy demand to drop drastically. Over the course of the previous months, we’ve seen a structural demand recovery as the economy restores from the first lockdown. And if we look at natural gas prices, this is also impacted by global developments where a swift recovery in Asia causes a rapid increase in demand.

We also have to look at the supply side of the equation. The extreme demand erosion caused by the lockdowns hit global fossil fuel markets that were already over-supplied. This caused extreme price drops, of which the negative prices for US crude oil were the most vivid example. This has caused producers to rapidly cut supplies, which can be seen, for example, in the drastic drop in rigs used to drill new oil and natural gas wells.

So, it’s good old Adam Smith again, the invisible hand at work, and this time there’s a particular role for the supply side which simply reacts to a period of very low prices. What comes down, must go up and around and around and around. We might be surprised at the speed of this year’s reversal, but that’s because we ignore the injection of dynamics in the markets caused by US shale production. Availability of that supply depends on the decision to drill or not drill extra wells, which has a very rapid impact.

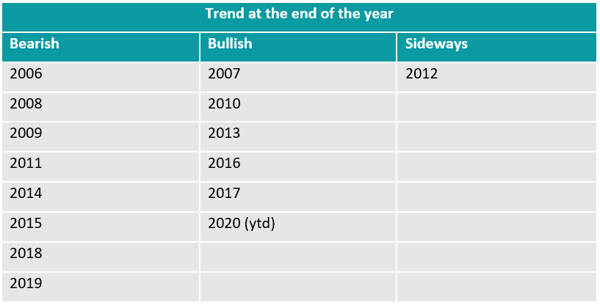

Markets go up and down, sounds simple, nevertheless, I see how ignoring it is the main reason why people fail to take good energy risk management decisions. Many people take decisions based on the current trend and without taking into account that this trend could reverse at any moment. Thinking in terms of trend reversals just seems to be much more complicated than thinking in terms of trends. This behavior of trending thinking is supported by the media. When you read an article on energy prices, most of the time it will only mention reasons why it’s increasing or decreasing at that moment. Rare are those journalists that end such an article with a few remarks on what could cause a reversal of that trend.

We’ve seen the perils of trending thinking in the past month when several clients approached us with the demand to “review the strategy and buy more in the spot markets”. This was often inspired by senior leadership that was convinced that the trend of low prices would never end. We invariably answer to this that spot prices are like thin air and that the only price you can grasp and fix is the forward price – and that even if they are 200% lower than the forward price – as some of them were earlier this year, it sometimes takes just a few days for them to rise above it. It took a few months this time, but our point was proven by market developments, once again.

Now that the market has reversed into a bullish trend, we start seeing the first people that “want to fix everything because it can only go on increasing”. Again, trending thinking that will result in price management disaster if (or rather when) the trend turns around.

We know for sure that trends will reverse, but we cannot know when they will do so. Ever since we created E&C in 2005, we’ve been advising clients based on this premise. That’s why we’ve never provided forecasts. In its most simple form, forecasts are just a rationalization of people’s reluctance to accept the inevitability of trend reversals. So-called trending forecasting models are based on deterministic thinking, projecting the dynamics of the past into the future. They analyze why markets are currently going up or down and give these as reasons why the trend will continue. “By the end of this year, oil prices could reach 200 Dollars per barrel”, said the hot-shot energy market analyst in 2008. And the analysis that supported this vision sounded and looked very sophisticated but at the end of the day, it was just a linear projection of the ongoing trend into the future. And then the financial crisis occurred…

(Linear projection of downward trends is more difficult of course, as prices can’t drop below zero. Oh, wait a minute, they did so earlier this year!)

Other providers of forecasting services try to unveil the trend-reversing phenomena, which is even more certain to fail. Energy pricing is for me a perfect example of chaos theory, where the spreading of the wings of a butterfly in the Amazon can ultimately cause a tornado in Texas. Many years ago, during a strong bullish period, a client asked me: “what could possibly cause these prices to go down again?” This was at the moment of Mers or Sars threatening to develop into a pandemic, so I quoted this as a possibility. The client laughed and said: “well, if this is the only thing you can think of, let’s fix everything”. Do I have to finish this story? What caused historically low prices this year? A pandemic indeed. However, for every tornado-causing butterfly in the Amazon there are millions or even billions more that spread their wings without causing anything. And that’s the same thing in energy markets. Now, with the benefit of hindsight, it’s easy to say what a strong bearish impact this pandemic had on the markets, but that doesn’t mean we should unfix all our positions as soon as somebody develops a strange cough somewhere on the planet (or eats a bat). Predicting what will cause the trend to reverse is impossible.

Should we then stop all hedging activity? Just ride it up and down with the markets? No. The fact that we cannot forecast markets doesn’t mean that we can’t run a hedging program that is based on firm rational principles and helps us to realize goals with an extremely beneficial effect on our company. We can do hedges, not to make bets on whether trends will continue or reverse, but to manage the risk of the trend reversals for our clients´ P&L. This is what E&C has been doing ever since 2005.

This starts with the analysis of the impact of energy cost variations on that P&L. Don’t be fooled by the simplicity of the categorization we use here, as this analysis is a very complicated fundamental strategy exercise. We drill it down to:

Having analysed the risk exposure, you can formulate goals and put in place the tactics to make the long term or short term hedges that fit your profile. Again, don’t be fooled by the apparent simplicity, but such a risk management strategy gives you all the guidance you need to take your decisions. It helps a market risk or survival risk client remain prudent and not do any bold fixings that burn P&L as markets start to drop – and it helps budget risk clients to stabilize costs by fixing parts of their prices at moments when bear trends reverse and do further protective fixings when the ensuing bull trend continues. It also guides clients in their unfixing decisions if they are allowed by their organization to do this. Important at this moment: it helps you to take the right decisions regarding long-term fixed price PPA contracts.

Apply this well as an energy buyer and you will never have to explain to your management why you lost so much company money by misjudging the trend (reversal). Apply it well as a company and you will never have to report bad financial results because of what happened in the energy markets. Sounds dead simple, but every day we see how buyers and companies struggle to apply it as they fight their tendency to base decision-making on forecasting and trend analysis.

Which brings me finally to answer the question in the title. What you shouldn’t do is trying to understand whether and why the current trend will continue or not. You don’t know, we don’t know, nobody knows. Just take rational decisions:

In such a bearish year, it’s a perfect decision for a budget risk client to keep the price open for part of the volume. As long as the market continues to go down, you’re just doing better and better. However, a few things to take into account:

Fixing up to 100% only works if you have a contract that allows you to do this, which basically means contracts where you fix in percentages of the volume and that gives you sufficient flexibility on the volume for which you fixed the price. Fortunately, in most European countries such contracts are available. But if, for example, you have a contract where you fix in capacity bands, it will be impossible to fix a capacity that corresponds exactly with 100% of your actual consumption. There will always be some volume for which the price depends on spot pricing (either by buying extra or selling back). This will influence your final price and needs careful management of your actual price versus the prices that you budget.

Volume risk, even within contracts with volume flexibility, needs extra attention in these uncertain times. Many consumers ran into volume issues during the lockdown period.

What started as a simple question became a long article on risk management. Many buyers are attracted by the simplicity and false security of a forecasting approach – and then get caught out when the trend they anticipated with their forecast doesn’t materialize. The logic of our risk management approach protects you against this.

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu