By Benedict De Meulemeester on 25/04/2016

Not all large U.S. energy consumers manage their natural gas and power prices in the same way. For natural gas, many have adopted a more advanced approach, buying with contracts that allow for advanced price management techniques such as layered purchasing. For power, most U.S. customers take a different approach - taking either a fixed price or a spot price, and limiting their ability to actively manage their budget through price fixings in the process. Why even opt for this second approach? One major factor is the lower degree of price transparency in U.S. wholesale power markets compared to Henry Hub for gas. That said, there is no logical or economic reason for approaching power price fixing differently. As one client remarked recently: “We’re spending twice as much money on power than on natgas, and 80% of the time we spend on energy pricing, we’re talking about the gas bills”.

How U.S. industrial energy consumers can improve their natural gas price fixing practices

Deregulated natural gas prices in the U.S. are almost always linked to Henry Hub pricing. Those industrials opting for fixed prices contract can simply follow the ups and downs of Henry Hub forward prices on NYMEX. For those gas consumers that want a more managed approach, contracts can be set up whereby prices are layered-in – in other words, consumers can lock-in a certain percentage of their volume – for a certain period – at NYMEX-traded prices for those periods.

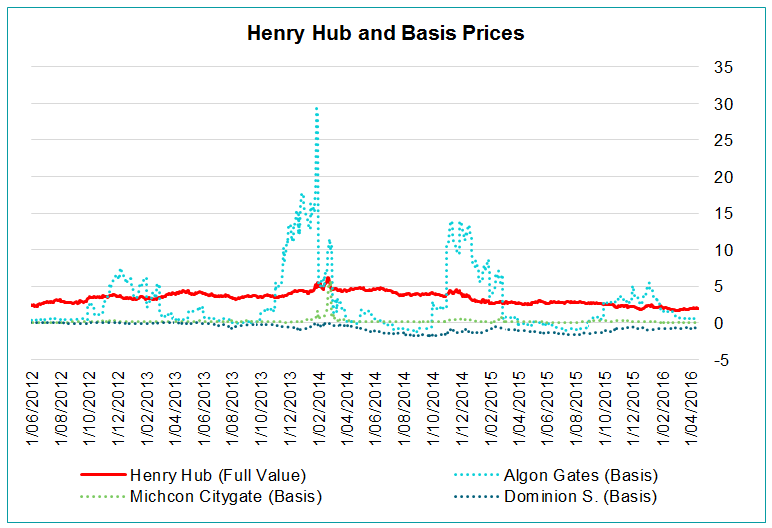

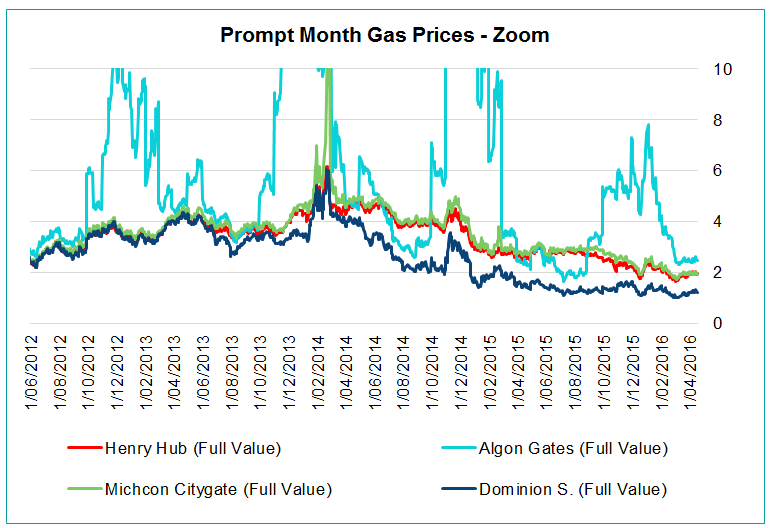

Buying natural gas is a tricky business because it involves a double moving target. Not only do you have to deal with the volatility of Henry Hub pricing, but you also have basis pricing to worry about. Your end price depends on the pricing differential between your local hub and Henry Hub. Depending on where your gas is produced or imported, supply / demand dynamics will be more or less favorable compared to the conditions at Henry Hub, resulting in a lower or higher price for the gas. This differential is then reflected in the basis price.

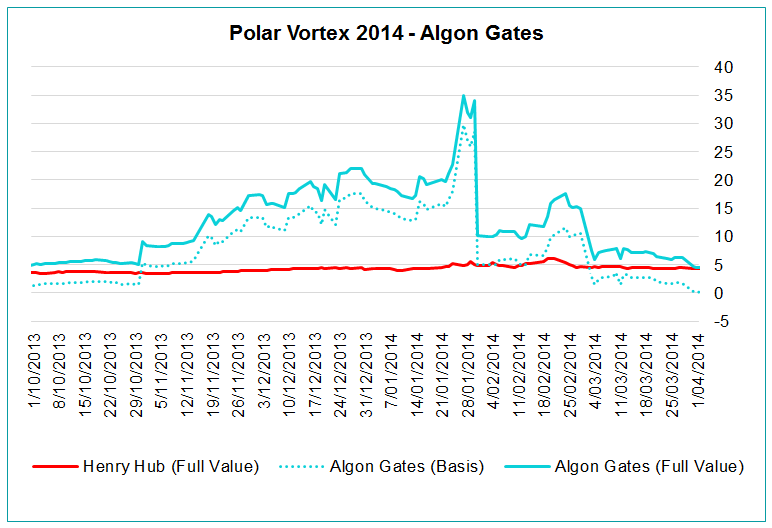

In recent years, for example, we’ve seen basis pricing for West-Pennsylvania and Ohio drop to negative levels due to the shale gas production. Moreover, gas marketers need to book the physical capacities on the network to bring the gas from the production site and these costs are added to the basis pricing. This gives rise to important differences in regional gas prices that change over time. During the Polar Vortex, for example, the increase in Henry Hub commodity pricing was amplified by huge increases in basis pricing in certain regions.

Many US gas consumers are only vaguely aware of the impact of basis pricing on their natural gas spend. All their attention goes to hedging their Henry Hub price and they completely neglect basis pricing. But as you can see from the graph above, basis pricing adds as much volatility risk to your final price as the Henry Hub component. A sound natural gas price management strategy will therefore take into account basis pricing as well as Henry Hub. It can take some time, but you can often find wholesale market information that gives you a good indication of what basis pricing you should expect. This can help you to select different moments for hedging your basis risk, which often doesn’t coincide with a good moment to layer in hedges on Henry Hub. Moreover, suppliers offer solutions where you can hedge basis in layers, in the same way you spread your commodity buying decision to reduce risk. With some efforts, both of the double moving targets involved in gas pricing can be effectively managed.

How power can be managed in the same way as natgas

Whereas natgas has a pricing system with one reference price for the whole country and basis pricing for different locations, power pricing is based on different wholesale price references. In the State of Texas, for example, there are no less than 4,000 different spot prices. Many of the consumers we speak to have no clue to what specific wholesale price reference their power price is linked to. They are equally unaware of the myriad of forward pricing products suppliers base their fixed price offers on. Many of them are also oblivious to the fact that, just as for natgas, suppliers offer the possibility of layering in power prices, allowing for more active price management.

By managing basis pricing for natural gas and using advanced price management techniques for power, U.S. companies can optimize the way they manage their budgets. While it’s true that floating with the market has often been the better choice given the bearishness of energy markets these past few years, it should always be kept in mind that going on index doesn’t offer any protection when markets turn around. Many customers were reminded of that during the Polar Vortex, when their monthly energy bills exploded. This is especially harmful for so-called ‘budget risk’ clients, businesses that do not have the option of passing on higher energy costs to their customers. For them, it’s a good idea to have contracts with layered forward purchasing features in place for when markets turn bullish. At historically low prices and with the US self-confidently increasing its production year after year, it is tempting to believe that low prices are here to stay. They will not - what comes down must go up. And if they do, many US customers will feel sorry that they didn’t lock-in some of the current low prices for future years.

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu