By Bart Verest on 2/12/2015

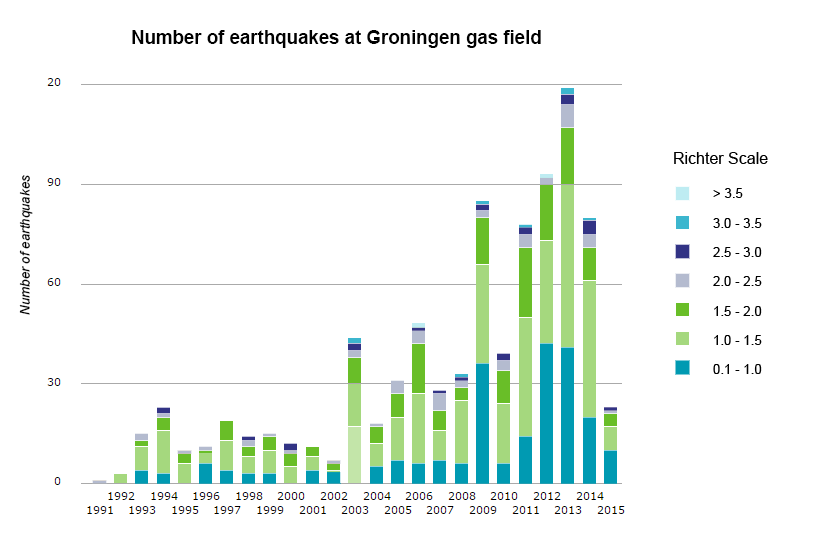

Last February, the gas market was startled by another episode of the debate on gas production in the Netherlands. The gas production in the Northern part of the Netherlands has brought the country wealth through annual gas revenues and the opportunity to develop itself as ‘the gas roundabout of Europe’. This production, which takes place since the 60’s, is accompanied by small earthquakes. For a long time, this geological activity was seen as an unpleasant side effect. But as a consequence of the diminishing amount of gas that is left in the Groningen gas field, the surface starts to move more and more. The increasing number of earthquakes and the earthquake in August 2012 near Loppersum seemed to be a turning point in the public attitude towards gas production. In 2013, when the production increased to a level of 53,9 billion cubic meters (bcm), the number of earthquakes peaked at a level of around 120. Some of them between 3 and 3,5 on the Richter scale.

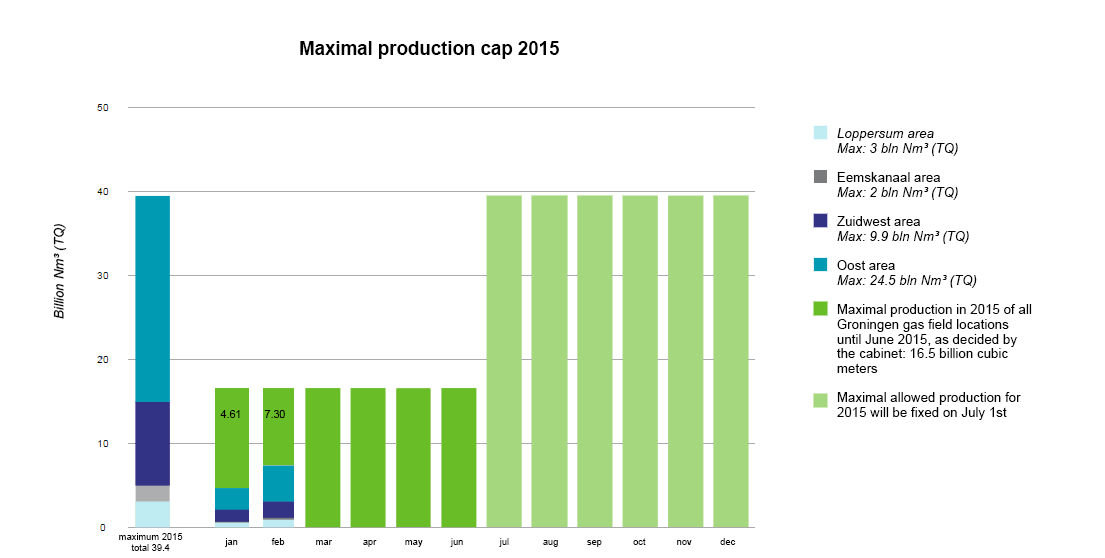

After the 2012 Loppersum earthquake, the NAM (Dutch Oil Company), KNMI (Royal Dutch Meteorological Institute) and the SodM (State supervision of the Mines) carried out additional tests. These showed, inter alia, that future earthquakes in Groningen could be much more intense than previously expected. Ever since, the government in The Hague is looking for a new equilibrium between economic and environmental and between national and regional interests. The Dutch government decided in January 2014 to limit the production of the Groningen gas field to 42,5 (bcm) per year for 2014-2015 and 40 bcm for 2016. Later that year, the maximum production cap was lowered again. For 2015-2016, no more than 39,4 bcm can be produced. In the beginning of February 2015, the Dutch government intervened again in the Groningen production limits and installed a production cap of 16,5 bcm for the first 6 months of 2015. The total amount for 2015 remained unchanged. In the days that followed this decision and in the run-up to provincial elections, the Dutch Green party ‘Groenlinks’ and some politicians from the Groningen area asked for a limit of 30 and 35 bcm for the whole of 2015.

The responsible Minister, Henk Kamp, did not give in and kept to his decision. On the 18th of March, Provincial elections were held in the Netherlands. These elections were important for two reasons. Firstly, voters in the northern part of the Netherlands expressed their aversion of the gas policy of The Hague. The Groningen region has been plagued economically in the past years and it is a thorn in their side that the revenues of the gas production are transferred to The Hague while they suffer the disadvantages. The regional party ‘Groninger Belang’, with their quest for structural solutions for the gas production in Groningen, panned out 3 seats and became the biggest regional winner.

This sent a clear signal to The Hague but the question remains whether this will have sufficient impact. Secondly, it was a test for the government of Prime Minister Rutte. The results were not in their favour. The labour party PvdA, the governmental partner of the Liberal VVD party, lost the elections. This has put pressure on the ruling majority. It is important to know that the provincial assemblies choose the country’s senate. Ever since the beginning of this government, the VVD-PdvA coalition had no majority in the senate and therefore had to ally with different parties to get their program passed.

The vulnerable position of the government deteriorated even more with these provincial elections. Will they remain strong enough to maintain their position on the Groningen production cap or will they have to make a trade-off with other focal points in their governmental program?

On the 1st of June 2015, Hans Alders was appointed as the National Coordinator for Groningen. In this function he goes on a tour around the Groningen area and is providing a platform to the people of Groningen to discuss the current situation. The feedback on his visits of the last months clearly point at a different interest between The Hague (gas and incomes) and Groningen (safety and restoration of the damage).

On June 22nd, minister Kamp published the 4th decree in a timeframe of 18 months. The production was limited to 30 bcm for 2015. This was less than the expectations because the last calculations at that time had pointed out that 33 bcm/year was the required amount of gas to foresee the Dutch households and to comply with the long-term export contracts. But apparently there was another 3 bcm left at the Drentse Norg which could be used in a case of shortage.

That production cap meant a loss of 2 billion euro per year for the Dutch treasury which is hard to handle in times of low economic activities and European calls to keep the budgets in balance. Moreover, the current gas revenues are already lower than expected due to the current low gas price.

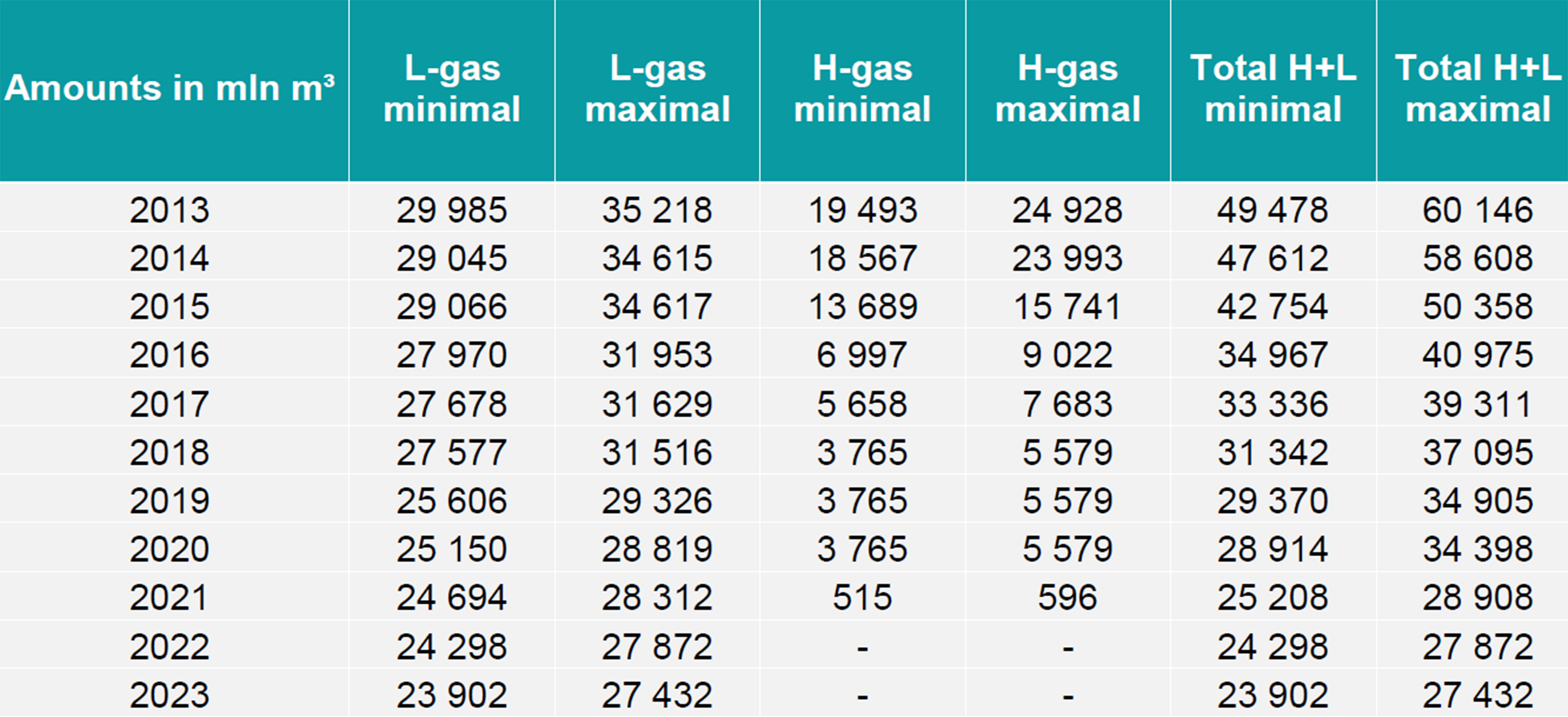

Not even considering this loss in income, it is technically questionable whether the NAM can decrease the production further. The gas that is produced in the Groningen gas field is low caloric value gas (so-called L-gas), whereas gas that is produced in the rest of the Netherlands and Europe is high caloric value gas (H-gas). This L-gas is used in the Netherlands and parts of Belgium, Germany and France and supplied by Gasterra. The exported volumes are traded under long-term contracts that contain volume conditions. Internal research of Gasterra pointed out that for 2015 they have to be able to deliver 34,6 bcm of L-gas for export (which can increase further with 1,8 bcm in case of cold weather). For the consumption of natural gas in the Netherlands, no distinction is made between L-gas and H-gas. Therefore we have no clear view on the Dutch demand for L-gas.

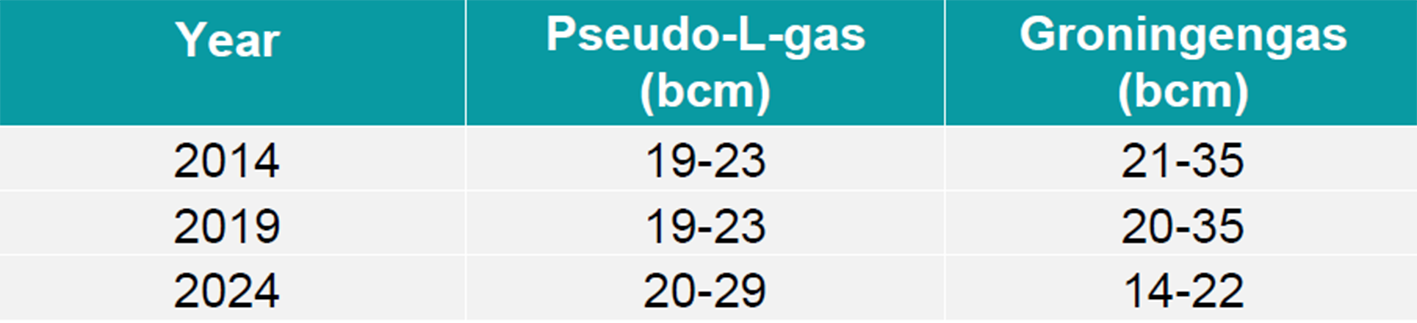

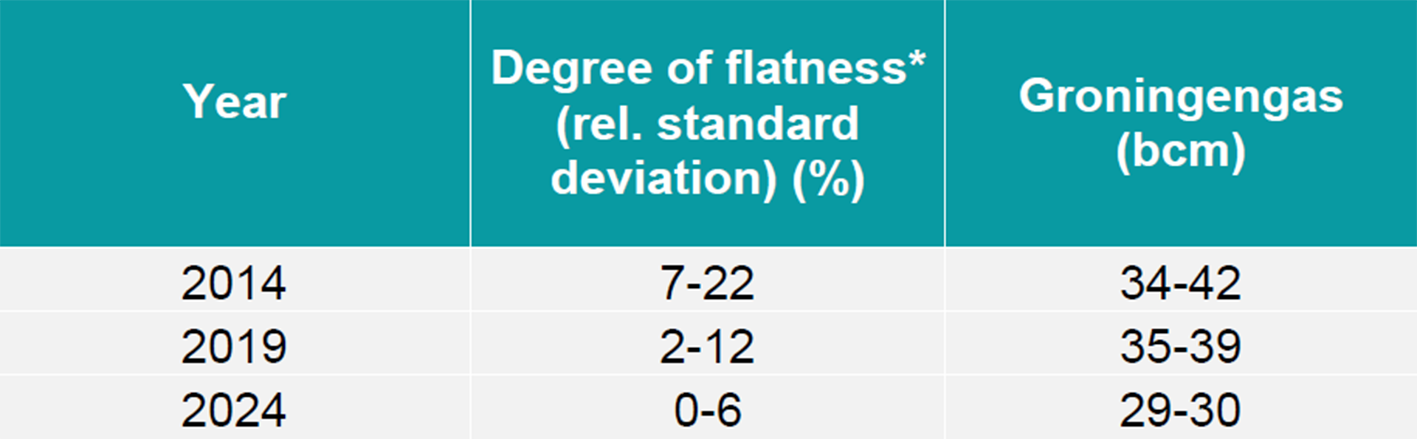

Not all of this L-gas has to come from the Groningen gas field since there is also the option to have the grid operator GTS convert H-gas to L-gas. This of course means a loss in caloric value and a cost increase but might provide a way out for a lower production in Groningen. The maximum amount of gas that can be converted depends on the maximum conversion capacity, the amount of additional H-gas available in the market, the temperatures and the quality of the H-gas. GTS executed some simulations based on this variables. The results of this show there is a need for 21 - 35 bcm of Groningen gas in the period 2014-2019 if the conversion capacity can be used in an optimal way. After this period, the need for Groningen gas reduces due to an increase of installed conversion capacity.

If the utilization rate of the conversion capacity is sub-optimal (due to seasonality in the Groningen gas production), the need for Groningen gas will be much higher.

But both the research of Gasterra on its export obligations and GTS on its conversion capacity show that the Groningen production cap can’t be put at any level.

Recently another episode was added to the saga. After more than 40 complaints were filed against the decision of Minister Kamp in June, the Dutch Court of State has to rule on this complaints. On the 18th of November the Court finally published its ruling: a rejection of the current amending acts of Minister Kamp and a new production cap of 27 bcm, with the exception of 33 bcm in case of a cold gas year 2015-2016. This new production cap was set in place to avoid that there was no more cap, which would have been very contradictory to the purpose of the ruling.

All this means that Minister Kamp has to come up with a new amending act which takes into account the ruling of the Court of States. So there is no light at the end of the tunnel yet…In a letter to the House of Representatives, Minister Kamp pointed out that more information can be expected on the 18th of December. So, save the date!

By Bart Verest

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu