By Benedict De Meulemeester on 13/10/2011

This week, I was speaking at a conference for Flemish procurement professionals on energy markets. I was a bit of an exception there, as I was the only person in the room that was not convinced that energy prices can only rise. In fact, this was another event at which buyers of energy were indoctrinated with the dogma of rising energy prices. And oh yes, there was even a forecast, and oh miracle, all the sophisticated econometrics applied in making it, resulted in a remarkably round figure. Power would cost 100 euro per MWh in the future! I am not saying that this is impossible, I am just saying that it is not sure. And buying energy (or any other commodity) out of a conviction that it can only get more expensive, will inevitably make you buy energy at prices that are too high. You just don’t take into account that it could fall.

The problem is not just that people – educated or not – so easily jump to the conclusion that energy prices can only rise. It is also that they do this regardless of what the price level is at that moment. Let’s return to the first six months of 2008. Oil prices were near 150 dollar per barrel, gas prices rose over 40 euro per MWh and power prices in North-West-Europe hovered near 100 euro per MWh. Every day, news articles were published that repeated the dogma: the price of energy could only get even higher. Oil prices would rise to 300 dollar, said a Goldman Sachs analyst. Buyers fixed prices. And saw themselves extremely on the wrong side of the market when six months and a financial-economic cataclysm later, prices were more than halved.

To the huge crowd of energy market bulls, I want to say the following. Your theories look very plausible, just like they did three or five years ago. BUT: there is no empirical evidence for your theories, rather to the contrary. A few demystifying remarks:

|

year |

Number of hours for which the EEX price was more than 4 x average price |

|

2001 |

48 |

|

2002 |

26 |

|

2003 |

39 |

|

2004 |

0 |

|

2005 |

55 |

|

2006 |

72 |

|

2007 |

70 |

|

2008 |

2 |

|

2009 |

2 |

|

2010 |

0 |

|

2011 ytd |

0 |

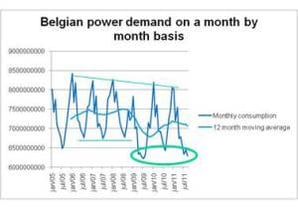

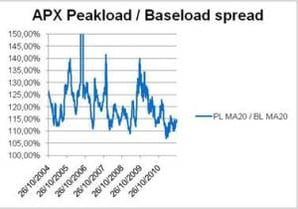

There are solid reasons why electricity markets are becoming less peaky. The flattening of power markets is a result of two evolutions:

- The increasing degree of physical and financial interconnection of the markets. Decreasing wind power output in Germany can be compensated by increasing gas-fired power input in the Netherlands.

- The evolution towards more gas-fired power production, increasing the flexibility of the market to react to price increases.

I am not claiming that energy prices are sure to fall in the next decades, I just want to point out that this is not unthinkable. We even think that if we are to start large-scale production of shale gas in Europe, a low power price scenario becomes quite realistic. I just want to make clear that prophecies that energy prices are sure to rise are based on: a negation of current trends and a biased selection of future scenario’s. Doomsday prophets sell better. That is why it so much easier to hear the ‘increasing energy prices’ dogma in the press than a more balanced view. And that is why so many buyers of energy take wrong decisions because they get convinced of that dogma.

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu