By Benedict De Meulemeester on 12/07/2017

When buying natural gas in the United States, you are facing a double moving target. On the one hand, the commodity price itself is moving up and down. Next to that you have the US natural gas basis pricing. The cost of basis depends on your geographical location. Not only are prices different for different places in the US, but they also go up and down over time.

In most contracts, the commodity part of your US natural gas price is pegged to the Henry Hub. This is a physical Hub, an actual geographical location in Erath, Lousiana, a nodal point in the US natural gas grid. This particular location has been chosen as the physical delivery point in natural gas futures contracts traded on NYMEX (the New York Mercantile Exchange). For that reason, the pricing of spot and futures on Henry Hub has become the US gas pricing reference.

Of course, if you have your site in New Jersey or Texas or anywhere else, you will not have the gas physically routed to Henry Hub and then to your location. For that reason, there is a market for so-called basis, a kind of geographical differential contract. They represent the difference in price between your location and Henry Hub. As such, basis pricing reflects the difference in the supply and demand situation between your location and Henry Hub. If natural gas is more scarce where you live than in Erath, Lousiana, the basis will be positive. You need to pay a premium on top of the henry Hub price. If natural gas is more affluent, you will have a negative Henry Hub natural gas basis, meaning that you can buy gas at a discount to Henry Hub.

Most industrial energy buyers run extensive risk and price management programs on Henry Hub by covering price levels in different moments and layers. There are two possibilities for this:

For basis pricing, many US natural gas consumers just choose between fixing when they sign the natural gas contract or leave it open for spot. Does this diversification of approach make sense?

Active energy price management means that you make decisions to fix, not fix, and in some cases even unfix volatile energy prices. Best practice, this is done in the framework of a pre-defined risk management strategy. You analyze the impact of energy price volatility on your business, and then you take your price management decisions to minimize that impact.

The volatility exposure on Henry Hub is clear. In the last three-and-a-half years, we saw Henry Hub average monthly spot prices moving between a maximum of 6.01 $/MMBTU in Feb/14 and a minimum of 1.70 $/MMBTU in March/16. That’s an 140% volatility swing.

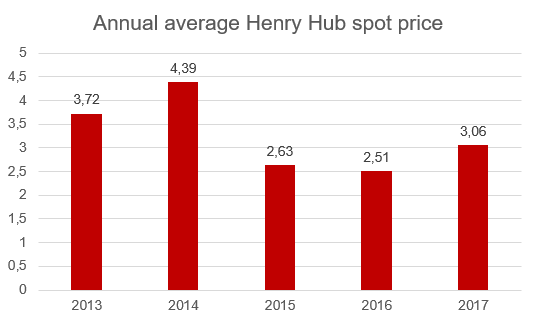

“No problem”, a spot prices fan might remark, I pay a bit more in one month, a bit less in another month and in the end it all levels out. Still, if we look at the average Henry Hub spot price per year, we see remarkable differences:

From 2014 to 2015, the spot price dropped by 40%. No buyer would object to that. But it can also be the other way around. In 2000, the average Henry Hub spot price increased to 4.31 $/MMBTU vs. 2.27 $/MMBTU in 1999, that is an increase of 90%. Seeing your annual spend on natural gas almost double does hurt, doesn’t it? And 2000 wasn’t an exception. In 2003, we saw a 63% increase, in 2005 +49%. And even in this year, 2017, the average spot price was already 22% higher than in 2016, that’s quite a lot of extra dollars.

Would you like to stay on top of US energy prices?

Whether you want to protect yourself against such increases or not depends on the impact on your financial bottom line. Some clients are what we call "market risk" clients. They are highly energy-intensive industries with the possibility to pass through extra energy spend to end consumers by increasing the prices of their products. Passing through a 90% increase might be challenging, but still, such clients are not or not fully exposed to the risk of lower profits when energy markets run up.

Moreover, if market risk clients fix on a forward basis and it’s a bearish period, they will have to lower the prices of their products because their competitors that didn’t fix lower theirs as they pass through the lower energy cost to the customers. That means that fixing too much too soon can lower margins. A market risk client is therefore making a good choice if he doesn’t fix. By skillful fixing (and unfixing), they can attempt to realize a price below spot, but this should always be done in small portions and with a good eye on the risk for the bottom line of ending up high above spot.

Some market risk clients might see a delay in the passing through of changes in energy costs to end clients. Many clients in the paper industry, for instance, tell us that it takes three to six months to negotiate price increases or get price decreases pushed through with or by clients. This could be mirrored with a fixing strategy for the next three to six months using monthly futures.

The large majority of clients are "budget risk" clients. If their cost goes up by a million dollars then the profits go down by that same amount. For them the big year-on-year increases in average spot prices are difficult to stomach. Moreover, higher bills during one month often cause heavy protests from stakeholders of the budget, such as plant managers.

Budget risk clients can only protect their bottom line by fixing energy prices on a forward basis. This doesn’t mean you always have to fix everything 100% and not take any benefit of lower spot markets. But as a budget risk client, you'd better have a good stop loss mechanism in place that helps you to protect the company against those 90, 63 or 22% increases. Moreover, for a budget risk client, it’s good cash flow stabilization practice to fix prices for several years into the future when forward markets have reached historical lows, e.g. in March 2016.

Most companies that we talk with lack the explicit analysis and defined strategy that identifies the risk exposure and puts in place the adequate buying practices. However, a lot of them run a hedging program on Henry Hub that reflects the underlying risk exposure. They make long term fixings when they are budget risk clients or keep on spot or run short fixing programs when they are exposed to market risk.

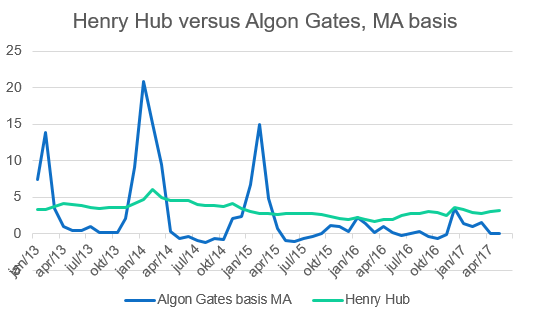

The question is whether the volatility of basis necessitates a similar program of fixing, not fixing, and unfixing. Those companies that have sites in the North-East will probably answer “yes” very loudly. The volatility on basis in Massachusetts has been much higher than the volatility on the Henry Hub component. If you left that basis open for spot pricing, then you saw your price per month run up from $0.22 /MMBTU in October 2013 to $20.80 /MMBTU in January 2014.

“Polar Vortex”, is of course the main explanation of that price increase. The extremely cold weather in that winter of 2013 – 2014 caused demand and prices to soar. The North-East has cold winters and was therefore particularly affected. But even last winter, without a Polar Vortex, we saw the basis in Massachusetts go up from $-0.62 /MMBTU in October 2016 to $3.46 /MMBTU in December. This is a lot less dollars than in 2013 – 2014 but still more volatility than on Henry Hub. The increases on North-East basis pricing are caused by bottlenecks in the pipeline infrastructure.

Moreover, the risk in these winter months is a triple whammy. Many companies see the price of Henry Hub, the price of basis, and their volumes increase in the winter months. The volume effect is particularly large for companies with a heating profile with a large portion of the natural gas used for heating buildings. Chances of high prices on Henry Hub and basis coinciding with a spike in consumption are very big for them.

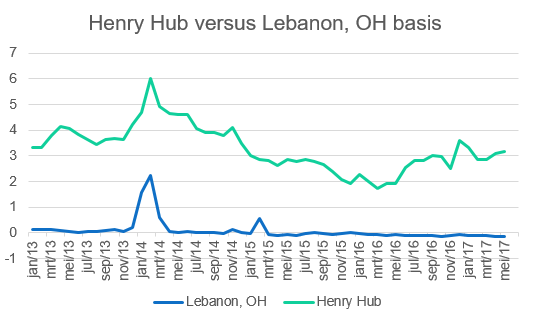

If we go more to the West, looking at basis pricing in Ohio, we see less volatility. In general, we see a declining trend with mostly positive values in 2013 – 2014 having turned into values below $0 since 2015. This reflects the increased supply in that region thanks to Marcellus Shale gas. Still, in Polar Vortex times, the average monthly basis price in Ohio increased $2.20, adding an extensive amount of money to the brutal cost increases already witnessed on the Henry Hub component of your natural gas spend.

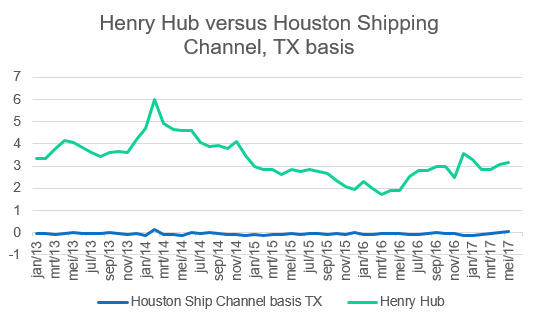

So how about Texas, where the sun was still blazing during Polar Vortex times? Moreover Texas which is full of production and pipelines? Basis volatility is much lower here, with just $0.30 difference between the most and the least extensive months in the last five years. Still, do keep in mind that this is an area with many chemical factories consume millions of MMBTU’s. Meaning that even these 30 dollarcents can cause hundreds of thousands of dollars of change in energy spend.

Whether or not to expand your price management activities to basis pricing therefore depends in the first place on where you are consuming natural gas. To leave basis open for spot in Texas is reasonable. To do this for winter months in Massachusetts when you are a budget risk client is insane.

For market risk clients, the risk exposure on basis is different from the exposure on Henry Hub. Your competitors might be producing natural gas in a region with less volatile basis pricing. This means that they are exposed to the same risk exposure as you for Henry Hub but not for basis. You might therefore opt to leave Henry Hub open for spot but run a stabilization effort on basis with forward fixings.

As you can see from all three examples of basis pricing, the risk is highly concentrated on the winter months. It makes sense, therefore, to concentrate your fixing efforts on winter.

A first step in rolling out an energy price management program on basis is to get transparency on the pricing, which is not as easily available as Henry Hub. There is a wholesale market for hedging basis through basis swaps. Transactions on these markets are OTC (over-the-counter) and not exchange-traded. However, a consultant such as E&C or a data provider can deliver you basis pricing information.

In terms of how you perform your forward fixings and unfixings, a lot depends on your consumption in the particular area. Large customers can be offered contracts where basis can be hedged in different moments, just like Henry Hub gas. If your consumption in a certain region is low, your options for managing basis price risk might be limited to the choice between fixing it or leave it open for spot at the moment of signing a contract with a provider.

As you can see, basis pricing can add sufficient risk to your energy procurement. It is therefore important to expand your risk management policy to this component of the energy cost.

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu