By Benedict De Meulemeester on 28/03/2017

When buying energy, you inevitably have to take energy trading decisions. In deregulated electricity and natural gas markets, the commodity value of the energy is linked to the underlying wholesale markets. On these over-the-counter (OTC) and exchange traded markets, the price of energy moves up and down. Buying energy means taking decisions on whether to fix the price or not and if you fix, whether to do it today or tomorrow. In volatile markets, these decisions can cause large variations in your energy costs.

Most buyers of large volumes of energy have clearly understood that the timing of your price fixings is the most important factor determining how much you will pay. They have put in place contracts with suppliers that offer them flexibility for the fixing of the wholesale value, contracts that allow you to fix in different moments on the different forward products and/or leave volumes open for spot indexation.

In most mature deregulated energy markets, the users are well accustomed to working with such products. But in countries where the deregulation is more recent, we still find that many industrial consumers have resistance towards this energy trading activity. They call it “speculative”, confusing trading with speculation. Energy trading is an inevitable component of buying energy in a deregulated market. You have to take decisions on whether you fix your prices or not in a market that moves up and down. That’s trading, whether you like it or not.

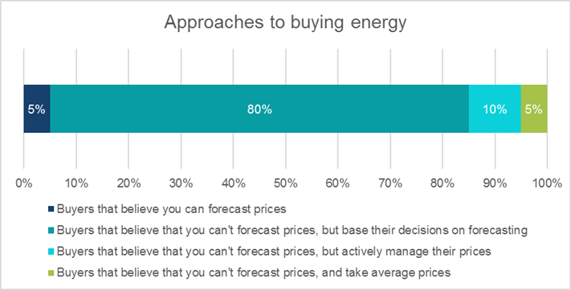

As trading is not a natural environment for industrials, we see many of them struggling to find the right approach to it. This struggle has a lot to do with people’s attitude to unpredictability. Energy markets are unpredictable. 95% of the energy buyers that we talk with acknowledge that.

5% of the buyers: you can predict energy prices

5% don’t. They think that you can ‘crack the code’, that there are mathematical laws determining the movements of energy markets. That you can unveil these laws and use that mathematical information to take decisions on whether to fix or not.

The popular argument for debunking that illusion of predictability is simple. If you would have cracked the code for predicting energy prices, why would you be an energy buyer? You would much better become a real trader, buy and sell speculative volumes and earn yourself a villa in the Bahamas. And any consultant or portfolio manager that has a forecasting that actually works would be very stupid if he or she sells it to an industrial client for a few thousand euros or dollars.

Energy markets are unpredictable. The supply and demand equation is extremely complex. The number of variables is very high and the interactions between them are not simple causal relationships. Most forecasting models are based on mathematic wizardry that unveils correlations. However, analysis shows that these correlations change over time, so a current correlation cannot be used to predict the future. Moreover, even if a correlation would be constant, e.g. between the price of electricity and natural gas, this knowledge doesn’t help you very much. It just tells you that one unknown factor (the future electricity price) is correlated to another unknown factor (the future gas price).

On top of this, international energy markets can be shaken by unexpected events. Some of those noticed in the recent past: the shutdown of nuclear power stations in France due to security issues, the impact on worldwide energy markets of the Fukushima nuclear disaster or the shale gas revolution in the US. Anyone claiming that she/he can predict energy markets, is claiming that she/he can predict such events.

Best case, forecasts are right 50% of the time. Therefore, they are not a solid basis for taking your commodity trading decisions. And if your energy buyer believes in forecasting, she or he is a danger to the financial health of your company. One day, she or he will take a decision based on a wrong forecast that makes your company buy energy on the wrong side of the market.

10% of the buyers: you can’t predict energy prices, so you shouldn’t trade energy

10% of the energy consumers accept the full consequences of this unpredictability. They choose to delete deliberate trading decisions from their energy procurement practices. They link their energy prices to the spot price, to an average forward price or buy at randomly chosen moments to produce an average price. We have a client, for example, that fixes the price for 1/24th of the expected consumption in each of the next twelve months on every 10th and every 21st of the month.

You will find this hands-off approach most often with very large consumers. If you are consuming Terrawatthours of electricity and/or gas, every decision to fix or not is a matter of millions of dollars or euros. Many companies decide that the energy buyer is not the appropriate person to do that. So they either set up a real trading desk, or they go for automated buying. We also observe that hands-off is much more popular among US companies.

E&C supports clients that want to set up a system for price averaging or automated buying decisions. The main challenge for them is to find an average that is in line with their risk exposure. Are they a budget risk customer that is mainly affected by large year-on-year cost increases? Then they should set up a system of automated buying for three or even more years in the future. Are they a company that can see its competitiveness affected by having a higher energy cost than competitors? Then they should find out how rapidly the prices of their products adapt to energy price changes and set up automated buying in line with it.

Nevertheless, giving up the taking of deliberate decisions to fix or not, is a bit of a pity. The large majority of E&C’s customers have a hands-on approach in which they take decisions based on energy risk management instead of forecasting. We see a lot of business value in that approach.

10% of the buyers: you can’t predict energy prices, but you can create business value by actively managing your prices

Active price management means that you adopt the following approach:

An energy risk management approach to buying energy means a totally different approach to the uptick versus turnaround dilemma. When making a price fixing decision, you should adopt a 50/50 approach. The chances that markets fall again the next day are exactly as high as the chances that they will continue to increase. This will inspire you to fix prices prudently, step by step. Let’s say that your energy risk management policy allows you to fix up to 50% of an annual volume in a certain moment. You could carve this up in four 12,5% tranches. When the market turns around, you fix a first 12,5% tranche. If it continues to go up, you fix another 12,5% tranche, and so on until 50%. If it drops again, you don’t fix anything and you have only 12,5% fixed on a temporary uptick.

This active price management approach produces excellent results. It allows a company to achieve pre-defined risk management goals. And because you make your fixings when markets turn around and not in the middle of downtrends, you’ll produce good results versus the market. A disciplined application of energy risk management, always spreading decisions and never make too large fixings because you think you know where the market is heading, will avoid energy trading disasters.

Hands-on active energy price management is definitely a great solution for budget risk customers. They can visualize their commodity costs for energy in the next years and then take the price fixing decisions based on goals, e.g. in a rising market: don’t let your cost increase by more than 10%. Or in an opportunity moment: cement a budget reduction by buying forward. For a budget risk client, this is a better approach than hands-off as you take your future costs in your own hands rather than let them randomly depend on how the market average prices you are buying are moving.

You can take your energy trading to a next level by adding an extra tool to your active energy price management toolbox: the selling of previously bought forward positions. If well-executed, this can definitely lead to great results, but it’s not the miracle solution that many consultants and portfolio managers try to sell you. Moreover, if you adopt the buying and selling approach with forecasting, you are doubling the financial impact of the 50% cases in which the forecasts are wrong (best case).

For market risk customers, the hands-off approach is excellent for achieving the main energy risk management goal, i.e. never have a price high above the market average. Active energy price management for them means the buying and selling of small extra volumes in opportunity moments in an attempt to do better than those market averages. It’s up to every company to decide whether to go that extra mile or not.

75% of the buyers: you can’t predict energy prices, but I want a forecast when I take an energy trading decision

Like we’ve said, there is only a very small fraction of the energy buyers that we talk to that believes you can predict future energy prices. However, a large majority of them cannot imagine that they take decisions to fix, not fix or unfix without some kind of forecast. This makes no sense. Why would you base your decision-making on a technique of which you acknowledge yourself that it doesn’t work?

The use of forecasts is deeply embedded in the business world. It has its roots in deterministic economics. Economists try to upgrade their science by making it look as exact as physics or mathematics with laws that produce correct predictions again and again. This branch of economics is often taught in business schools. And it is sold to businesses by consultants in the shape of forecasting services. They are either based on the guru status of the consultant or on a sophisticated-looking mathematical model.

Albert Einstein taught us that even in physics forecasting will not always work (I’m not going into the details of quantum physics to explain this). And in mathematics, we have chaos theory. It still believes in a deterministic physical reality, there is a set of initial conditions that determines the outcome. But this reality is so complex that it is impossible to trace that chain of causal effects. The butterfly effect describes how a small change that is impossible to trace can have large consequences. A butterfly flapping its wings in the forest in Brazil can cause a tornado in Texas.

The butterfly is an excellent metaphor to illustrate the complex, chaotic environment of energy markets. Forecasting systems will invariably over-simplify this, leading to wrong forecasts. But as human beings, we are so allergic to the uncertainty of unpredictable chaotic environments like energy markets that we keep buying the false certainty of forecasting.

I think about a recent meeting with the energy buyer of an international food company. He told how every month their board had a presentation by a professor that gave his vision on the world economy and how it would affect pricing of diverse commodities. Decisions to hedge were then based on that vision. So, we commented: “if the professor gets it wrong, the economic health of a company with thousands of employees will be affected”. “He is very clever, he gets it right most of the time”, was the energy buyers’ answer …

I also think about other meetings during which energy buyers’ acknowledge that forecasting doesn’t work. However, they buy forecasting services and base their energy trading decisions on it, because then they know why they took wrong decisions … Some even said: “we then have a consultant to whom we can transfer the blame” … I’m sorry, I’m a consultant that respects his job and I will never sell myself as a scapegoat.

It’s all the more sad that so many energy buyers keep holding on to forecasting even if they know that it doesn’t work, because they don’t need it. The active energy price management approach described above produces excellent energy trading results. It is simply a much more rational approach to buying energy than holding on to the false certainty of forecasting. It’s E&C’s mission to convince large energy consumers of that and help them to implement an energy trading practice that is not based on false forecasting.

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu