By David Lamoulie on 28/11/2017

Topics: Energy Controlling

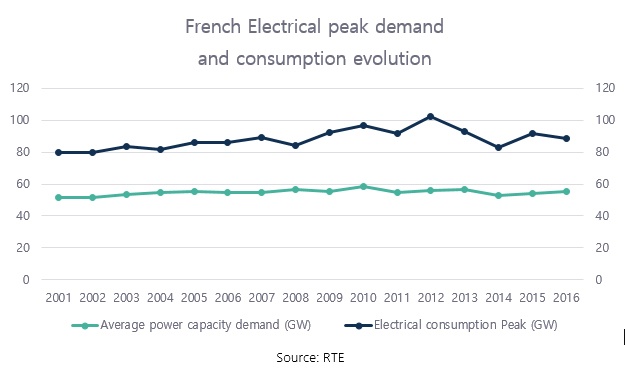

The strong increase of the French winter peak consumption in the last decade, driven by the high use of electrical heating, has spread fears of possible winter blackouts.

To avoid such a risk, the French government validated its plan for a capacity mechanism on the 29th of November 2016 after the approval of the European commission. On the one hand the mechanism wants to modify the consumption behaviour during peak periods and on the other hand it wants to stimulate investments in capacities of energy production.

The mechanism kicked off in January 2017. Energy suppliers are now assigned a capacity obligation each year. This obliges them to make sure they produce sufficient capacity to foresee in the actual consumption of their clients during peak periods. The capacity certificates, sold by energy producers and sites that can decrease their power capacity on demand, will be exchanged by auctions and on OTC. One capacity certificate is equivalent to 0.1 MW.

Energy suppliers include this cost into the end consumers’ formula. As an end-consumer it can be useful to calculate your own obligation for multiple reasons such as setting up your energy budget or evaluating a suppliers’ offer.

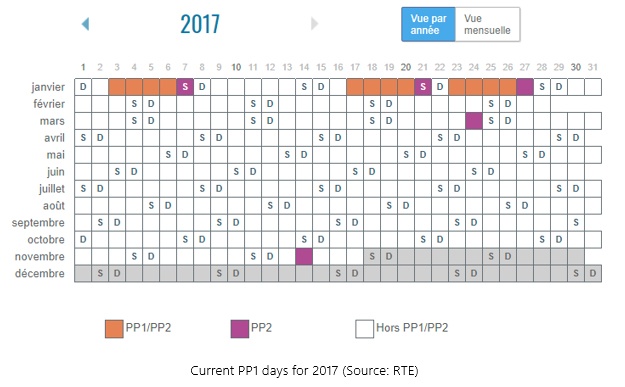

The obligation depends on your consumption profile during the PP1 peak period. This period covers 10 hours per day (from 7 AM to 3 PM and from 6 PM to 8 PM) for 10 to 15 days per year between November and March. The amount of days is not defined in advance. For 2017 twelve days have been notified by the transmission grid operator RTE as PP1 days so far.

PP1 days are announced one day before on the website of RTE.

Before each year starts, the French Regulatory Commission of Energy (CRE) announces a reference price for certificates. The price reflects the average price of the exchanges during the different auctions.

The certificate price was initially capped at 20 000 €/MWh and after the auction of December 15th 2016, the reference price for the contract 2017 was set at of 9 999,8 €/MW. As one certificate equals 0,1 MW, this results in a price of 999,98 euro per certificate. For important industrial sites with a stable consumption profile, this means a cost increase between 1 €/MWh and 2 €/MWh on the electricity invoice compared to the year before.

For 2018 and 2019, the maximum price of the capacity certificate is set at 40 000 €/MW and 60 000 €/MW for 2020. The first auction for 2018 took place on the 27th of November 2017 and ended at a price of 9,31 €/kW or 9 310 €/MW. The second auction for 2018 will take place on the 14th of December 2017. After this auction, the average auction price (PRM) will be known. For clients indexed on PRM, it means that 50% of their capacity certificates is hedged at a price of 9,31€/kW.

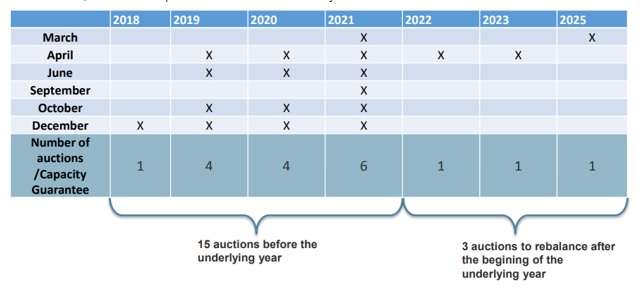

The first auction for 2019 will also take place on the 14th of December 2017. Once the mechanism becomes more mature, auctions are planned to be numerous as you can see below:

Source : Epex spot Exchange

To calculate the final obligation value of the consumption profile, a security factor is considered. The value for 2017 is set at 0.93. The security factor reflects the margins required to cover other unforeseen circumstances, especially on the demand side (excluding temperature sensitivity) and the contribution of interconnections to security of supply.

Find out what impact this capacity obligation has on your energy budget. Download our file that will explain you step-by-step how to do so.

Regarding the procurement process, suppliers offer possibilities to buy at the CRE reference price (9 999,8 €/MWh, or 9,9998 €/kW for the 2017 contract as mentioned before) or at an OTC price. The last option has the advantage of providing more visibility on your budget.

As the first auction for 2018 ended at price of 9,31 €/kW, far lower than the OTC market (price between 12 and 13€/kW), buying an important share on your capacity certificate on the PRM or auction prices can be interesting. As there would more and more and more auctions spread in different years, even choosing the PRM option would bring some visibility on the capacity certificate budget.

If you anticipate changes in your consumption profile, it is advised to request an addendum with the possibility of obligation recalculation based on your real consumption.

If you’re buying a certain volume of your electricity under the regulated ARENH tariff model, you do not need to pay an obligation on this part of your consumption profile because the capacity certificates are already included in the ARENH price.

You should consider this difference when you’re comparing the cost of buying electricity on the deregulated market to ARENH. The ARENH price is currently at 42 €/MWh. If you take into account the cost of a capacity certificate, this means that the price of your baseload on the deregulated market only becomes advantageous compared to ARENH if it’s below 40 €/MWh. However, this does depend on your consumption profile and the actual capacity price.

Need more information on the French electricity capacity market? Feel free to contact David Lamoulie.

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu