By Siobhán FitzGerald on 29/10/2020

Topics: European Energy Markets, Natural gas, LNG, Nordstream2

As the completion of Nord Stream 2 (NS2) edges closer – with a little over 150km left to lay in Danish and German waters – we consider the ramifications of this new influx of gas supply coming into Europe. True, some are still unsure if it will actually be finished with block after block halting construction over the past 4 years. But if it does open in 2021, and an extra 55 billion cubic metres (bcm) becomes available in the European gas market, what impact will this have on the security of supply in Europe, the gas prices, and the import of LNG? We discuss these topics in this article.

European energy market

As NS2 has a direct link to Germany, the spotlight inevitably falls here. Below is a summary of Germany´s energy situation.

In 2016, Germany imported 49.8 billion cubic metres (bcm) of gas from Gazprom. Statistisches Bundesamt publishes the latest monthly gas imports to Germany.

Germany reflects the situation in Europe; almost 60% of the EU’s energy needs (excluding the UK) were met by net imports in 2018, and Russia is the main supplier of both oil and natural gas. The International Energy Agency (IEA) goes further, stating that “Europe’s import requirements are expected to increase by over 10%, or 45 bcm/y, in the next five years, despite stagnant demand. This is driven by a rapidly declining domestic production in northwest Europe”. This then points to further reliance, and with NS2 ready to take up the mantel, there is concern especially in light of Europe´s plans for a European energy union.

The most recent controversy surrounding NS2 centres on the EU´s concerns that NS2 could harm the development of an open gas market. At the moment, a network of LNG terminals and pipelines ensure a balance of dependence throughout Europe (see image below).

The concern, voiced by the EU Commission, is that NS2´s new capacity would reduce the use of existing connections, to be replaced instead by a “single dominant transport corridor”. For Germany, this issue is compounded by the fact that one of their main sources of gas – the Netherlands – is due to stop. Production from the Groningen field is declining and due to fully terminate by mid-2022 at the latest. Norwegian exports, however, should remain stable and provide some flexibility to the European gas market.

Germany´s Energiewende is moving the country towards more renewable energy. However, regarding Germany´s gas dependence, planned nuclear and coal phase-outs are set to increase their reliance on natural gas, including as a backup fuel source for renewables.

The question then is what the initial effect of NS2 on the gas market in Europe will be, especially if Europe is serious about ensuring the diversification of its gas supply – including through the direct import of LNG.

Impact of NS2 on the European gas market

With NS2 active, it will increase the flow of gas into Europe and, depending on demand, push down prices. The spot price level will determine the appetite, but with bigger volumes flooding the market, the prices will be kept low.

Another factor to add to the mix, according to the IEA, is the expiry in the coming years of long-term European gas supply contracts, which will create market opportunities for both pipeline suppliers and for LNG to enter the European market. Good news for diversifying supply, as well as for US LNG imports.

However, according to the Energy Economics Institute (EWI), once NS2 is available less LNG needs to be imported into the EU, leading to lower import prices for LNG, which in turn decreases gas prices in Europe. EU wholesale gas prices could be between 13% to 32% lower than if NS2 was unavailable. This would be especially so for the northern European countries, due to the proximity to NS2.

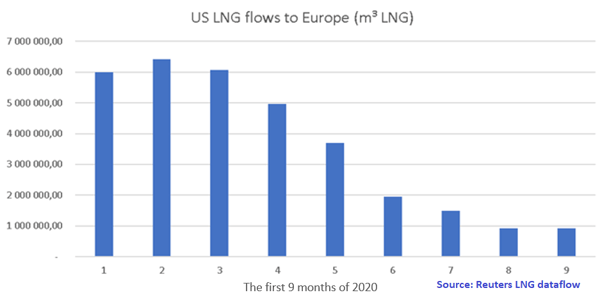

The latest on US LNG

As reported in our last blog, The viability of importing US LNG to Europe, the LNG market has seen some drastic changes over the past 12 months. Over the summer, LNG imports from the US declined drastically. This was to be expected given the high European stock levels and low demand over the months June to August. September looked slightly better compared to August. Flows over the summer were entirely concentrated in Southern Europe: Greece, Italy, Spain and Turkey as these countries depend a lot on gas for power production and also because they don’t have as easy access to gas produced in Northern Europe (Norway, The Netherlands). The UK and the Netherlands remained classic destinations.

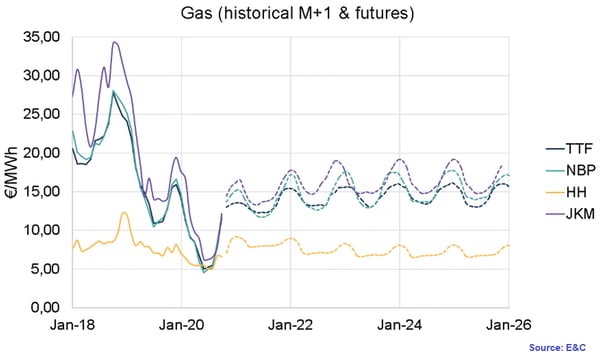

Despite this recent fall in imports, there had been a boom in US LNG coming into Europe over the past year, which has resulted in most international gas indices converting to a comparable level (and in fact enabling more LNG exports by providing buyers effective means to procure gas and hedge their exposures). This effect is expected to continue as long as the spread between Henry Hub (the US gas distribution hub) and indices elsewhere in the world are large enough to make LNG shipping profitable.

If, however, NS2 results in EU gas prices below the level at which it is profitable to ship LNG from the US to the EU, we could see the gas indices of different parts of the world (excluding the US) divert again. Conversely, as Russia already exports a lot of gas to China through ‘Power of Siberia’ having a maximum discharge capacity of 61 billion m³/year, this could keep the European and Asian indices close together after all.

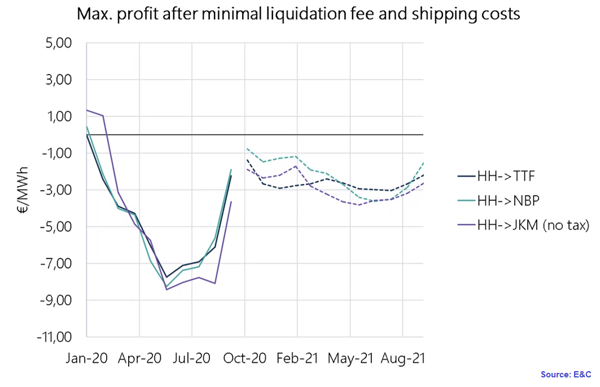

We have analysed the spread between the different prices to see whether it is beneficial for US LNG to continue to be transported to Europe. At the moment Henry Hub is much lower than TTF and the Japanese-Korean marker (JKM). From this spread we subtract the suspected costs to liquify natural gas and transport it to those regions.

As we can see below, based on our extrapolation, it would be more economically advantageous to send LNG to South-east Asia at the beginning of the winter period (when JKM is higher than TTF) but starting from February/March it would be more profitable for the US to ship LNG to Europe (when JKM drops below TTF). This possibility is backed by the fact that over the past few months the TTF premium to HH spread has increased.

In the chart below we see slightly negative numbers, which suggests that we have slightly overestimated the costs showing it is not profitable at the moment to ship LNG to Asia nor Europe. A reason for this might be our use of typical shipping costs of last year and as oil has decreased in price, shipping cost have probably declined as well (also because of the lower economic activity, more ships might be available again).

According to the IEA, Europe is also expected to continue to play a key balancing role in the global LNG market, given its access to spare regasification capacity, ample storage space and liquid pricing hubs. LNG imports are expected to oscillate in a range of 90-110 bcm/y through the medium term.

The big question indeed is if Russia will be able to produce and transport gas (through pipelines) to Europe/Asia at a rate lower than what is profitable for LNG transport from the US to these parts of the world. Will this be another price war similar to what we´ve seen for OPEC+ and oil?

Of course the EU´s move towards its 2050 emission targets could mean a move towards low and zero-carbon gaseous fuels, such as biogas, biomethane, (blue and green) hydrogen, and synthetic methane. This depends on each EU country´s efforts to reduce emissions in the coming years, but we would do well to keep an eye on these emerging markets.

Lower gas prices are indeed not surprising if NS2 opens next year. What remains to be seen is:

We asked our CEO, Benedict De Meulemeester, what he thinks about this:

Nord Stream has always been commented upon with strong geopolitical sentiments. And lots of analysts and journalists get carried away by that. However, what many ignore, including the investors in this pipeline, is the law of communicating vessels when it comes to energy supply. The more sources of supply we’re connected to, the better, as it gives us Europeans as buyers more options to choose from and increases the chances of over-supply.

Russia’s intentions in building the double pipeline have always been clear: they want to dominate European gas supply. That was their plan when they built Nord Stream 1 but that plan failed. You can’t push other suppliers out of the market by simply building a bigger pipeline than the others have, neither can you push away LNG supply. Russians keep thinking that markets work according to the laws of power politics. They don’t. Let them build that last stretch of Nord Stream 2. Adding 55 bcm of extra import capacity is massively increasing the chances of over-supply and low natural gas prices for European consumers.

Ten years ago, when Nord Stream 1 was built, I heard somebody from a company affiliated with its construction say: “the Russians will first flood the European market with cheap gas and when they have pushed their competitors out of the market, they will increase prices”. Well, then as now my response is: “that’s not how it works”. The gas price dropped to an absolute low of 3 Euros/MWh this year. Those competitors can put natural gas in a boat. The LNG import terminals might stand idle for a while if Europeans buy cheap Russian gas through Nord Stream, but as soon as the Russians start increasing those prices, the boats will come back. Communicating vessels. European policy should just support the open market models that make this law of communicating vessels work. And, as the energy transition goes on, at some point Europe will have to find out how it phases out natural gas consumption, although this might be a few decades ahead. But opposition to Nord Stream is based on political sentiments, not economic observation.

I completely understand the strong emotions in Poland regarding Nord Stream. Every time I look at that map and see that pipeline land just across the border of Germany and Poland, I can’t believe what an absolutely boorish act of German energy policy that was. How utterly insensitive of historical sentiments. What a failure of European solidarity. Nevertheless, the Polish shouldn’t get carried away by these geopolitical sentiments either. For them as well, adding extra bcms to the market is good news. Let the Germans and Russians pay for all that steel on the bottom of the Baltic. Put down a few extra kilometres of pipeline connecting Poland to the German, increasingly pan-European gas network. Support the strengthening of a North-to-South gas corridor east of Germany. And that way this Russian gas will flow into the Polish market just as well, albeit coming from around the corner.

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu