By Joke Bruneel on 23/07/2019

Topics: Energy Markets

If you’re wondering where to find out which countries are sticking to the Paris’ Agreement, there’s one website to navigate to: Climate Action Tracker. The Netherlands is within the range “insufficient” meaning that if other governments would have the same targets, we’d end up at a global warming between 2 and 3°C instead of 1,5°C. Well, there’s worse students in the class (our friends Trump and Putin are heading for more than 4°C), but the Netherlands Environmental Assessment Agency dug deeper and calculated how much megaton had to be reduced in order to reach the goal of 49% less emissions by 2030 (Paris Climate Agreement): 48,7 megatons. One small issue, at the current pace the country would end up somewhere between 31 and 52 megatons.

One of the current systems to defeat carbon emissions in Europe is our European Emission Trading System. It’s a cap-and-trade system where a price for greenhouse emissions is established and the size of the emissions allowed is predefined. Even with prices evolving from below 5 euro two years ago to prices of 28,29 (July 11th, 2019 – subscribe to our daily market analysis if you’d like to receive price information right in your inbox), it looks that won’t do the trick.

There’s an alternative: carbon taxes. In such case mathematical models are supposed to predict the amount of emissions that will be reduced, and you’ll have to pay fixed fees. But make no mistake, from an energy risk management perspective this isn’t an ideal solution either: If emission reductions aren’t met, the tax can easily be adapted upwards. Not ideal for the general investment climate.

Several countries already have such a carbon tax. In South Africa, a country where a lot of steel producers with energy costs up to 40% are based and heading for a global warming between 3 and 4°C, it’s set at $8,34. Canada has one at $15 per ton since 2019 and it will rise to $38 per ton by 2022.

The Netherlands also presented a carbon tax, as a part of the Climate Agreement on June 28th. However, this one will exist next to the EU-ETS system.

Why does the Netherlands want to implement a carbon tax?

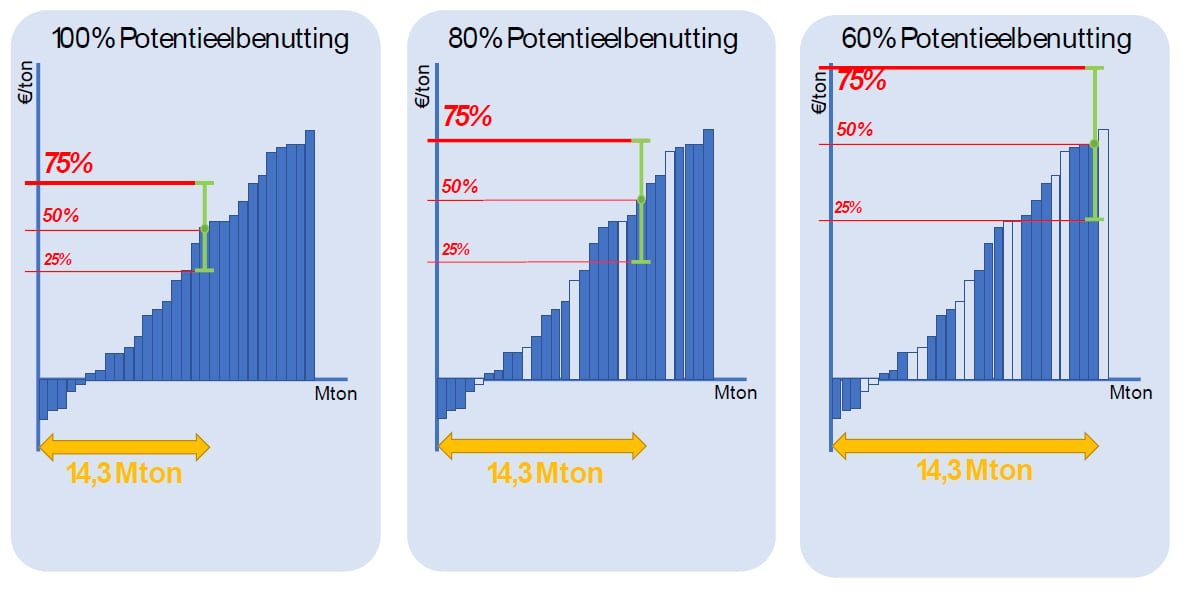

After the earlier mentioned calculations of the Netherlands Environmental Assessment Agency, the government decided to add another 14,3 Mton of emission reduction to their current target. This will increase the percentage of emission reduction compared to 1990 to 55% in case the goal is reached. A carbon tax should help to combat this 14,3 Mton.

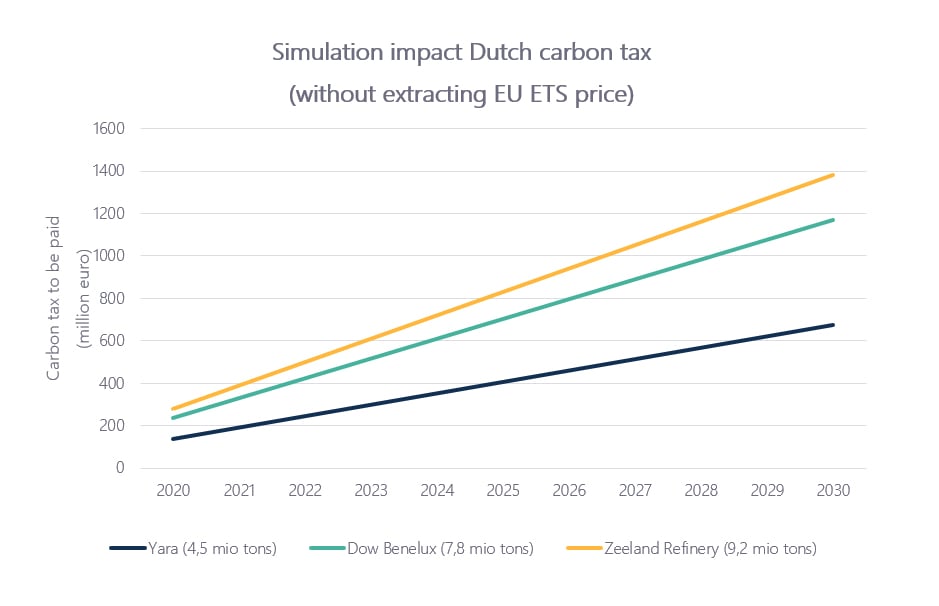

The level is set at 30 euros for 2021 but the price you already paid for EU-ETS certificates will be extracted from this. (In case of free allocated allowances, we expect the government to define a price, which could for example be the average price of Y-1.) The tax may increase to 125-150 euro/ton of CO2 emitted in 2030. What will the level of EUA certificates be at that time? Anyway, we had a look at the emissions of a few large industrials in Netherlands. If this tax would be applied to their 2018 emissions, the extra cost would look like this.

Simulation based on emissions found through the following source: https://ec.europa.eu/environment/ets/welcome.do

Simulation based on emissions found through the following source: https://ec.europa.eu/environment/ets/welcome.do

How is the levy of the carbon tax defined?

Every possibility to reduce carbon is plotted on a curve, starting with the cheapest ones. The most expensive measure to reach the 14,3 Mton reduction defines the levy needed by 2030. This marginal abatement cost curve takes into account that 80% of the potential to reduce CO2 can be used. By starting with a lower tax levy, the easiest investments will be implemented first. Each time the levy is increased, other investments will become more interesting as their cost will be lower than the carbon tax. The levy will be recalculated in 2020 and 2025, once the new EU-ETS benchmarks are published as they give an indication on how efficient industries actually are.

Source: Climate Agreement page 99

Source: Climate Agreement page 99

Who needs to pay this carbon tax?

The target group of this tax is mainly the same at the one of EU-ETS (watch our webinar on EU-ETS to find out more) but also includes waste incineration plants. Only the electricity sector is excluded from this scheme. Note that companies that get free allowances under the EU-ETS system will also need to pay this carbon tax. Being within the 10% most efficient companies of their industry does not mean they’re exempted.

How will the industrial innovations be paid?

The purpose of the carbon tax is to stimulate companies to take the necessary investments instead of paying the carbon tax, hence the government does not expect a lot of gains through this carbon tax. However, if there are any, the revenue should be used to green the industry. So how should the necessary innovations be subsidized?

The current SDE+ subsidies will be broadened as the adaptation of the name implies: “Stimulation of Sustainable Energy Production” becomes “Stimulation of Sustainable Energy Transition”. The scheme will now also reimburse CO2 reduction in other sectors such as the industry next to compensating the unprofitable component of generating renewable energy.

However, the Levy Renewable Energy (“Opslag Duurzame Energie – ODE”) provides the means for this SDE+ and will also be increased. The current levy for 2019 depends on your consumption, divided in 4 tranches, and varies between 0,0003 and 0,0278 euro per kWh. It’s paid by both households and companies that use gas and electricity, but the government wants companies to contribute 2/3 instead of 1/2 of the amount needed as of 2020. Hence, the charge would be increased in the two highest tranches. But wait a sec, “companies that use gas and electricity”. How about the heavy polluting coal and oil-fired installations?

SDE+ will also cover Carbon Capture and Storage (CCS) but only if there is no reasonable alternative and for a maximum of most 50% of those 14,3 Mton and after 2035 only for negative emissions (in combination with capture from air or from biomass use).

Next to this, there’s also another regulation coming up for electricity producers compliant to EU-ETS: Minimum Carbon Levy. It would be set at 12,30 euro in 2020 up to 31,90 euro in 2030. In case the EU-ETS price is below, the remaining amount up to 12,30 or 31,90 euro will need to be paid. Question is whether the EU-ETS price will ever be below that level…

The government clearly states that it’s aware that carbon leakage needs to be prevented by all means as this does not only influence employment, but it would also mean carbon would still be emitted, albeit in another country. This will be monitored, and measures will be taken in case there’s a threat of job loss at healthy companies because of the new regulation.

The starting date of the Climate Agreement will be January 1st, 2020 but of course, the regulations all need to be finalized and accepted first. This is expected in the second half of 2019.

The positive side of this story is that this makes power purchase agreements even more interesting. Have a look at our recent white papers on this subject if you’d like to find out more.

Feel free to leave a comment and share our blog posts on social media!

E&C is an energy procurement consultancy with an international team of energy experts that offer a unique blend of global capabilities and local expertise.

Our offices in Europe, the US and Australia serve more than 300 clients from South-Africa to Norway and Peru to Australia that have an annual spend between 1.5 million and 1.5 billion dollars.

E&C Consultants HQ

Spinnerijkaai 43

8500 Kortrijk

BELGIUM

+32 56 25 24 25

info@eecc.eu